Kip Johann-Berkel

@BerkelKip

Small cap investor. Enjoy flipping rocks.

Great book list and imho Bill has a ton of very insightful comments - one of the most criminally under-followed FinTwit contributors.

Great list! Just my two cents, but would consider adding Taleb’s “Fooled by Randomness” and “Antifragile” to that list (“Black Swan” and “Skin in the Game” also excellent), along with “Meditations” by Marcus Aurelius and “Letters from a Stoic” by Seneca. Taleb’s books are highly…

Just a reminder that even experts can be wildly wrong. Never underestimate technological innovation! From the book “Oil 101” - published in 2009!

When I applied to MIT (in 1997!) I wanted to focus on artificial intelligence. Kind of ironic that I gave up on the AI path because it seemed to be just a big if-then statement at the time 😂😅

Sadly, I think this is the best argument for why the small “factor” (SMB) from Fama-French might be structurally broken.

There’s something sad about the fact that great companies go public with all the gains captured by private investors Amazon IPOed at $500m. Nvidia? $50M! Hard not to think we’ve lost something great about the equalizing force of capitalism over the last 30 years

First time I've seen a "notification of major holdings" for a dead person. Might be able to get decent volume for anyone interested $FKE.L :

Fiske plc $FKE.L is a negative EV, profitable, growing nanocap that's a decent business (wealth & investment management) - too small (GBP 8m mkt cap), even for me, but figured I'd flag in case others are interested. It's AIM listed so even more caveats than normal! 🤣

I can’t believe IKEA is capitalizing on this 🤣

This is finishing me! 😂😂😂😂😂

Might help explain why Swedish companies typically have a higher success rate expanding into Norway/Denmark/even Northern Europe vs. Finland!

pretty cool. Finnish, very artisanal

Sometimes I do wish I would short… $SLP

Quick no for me: when mgmt pays a very expensive price for a "strategic" acquisition. E.g. Simulations Plus $SLP paid $100M for Pro-ficiency in June or 6.7x EV/Sales. Helps explains why returns have gone from great to poor (and stock -19% over the last 5 years)

It’s proven: “given 15 minutes on their own in an empty room, two-thirds of the male participants ended up giving themselves a shock to avoid the tedium of their own company” 🤣 - arstechnica.com/science/2014/0…

What’s that quote.. something like man’s biggest problem being his inability to sit quietly alone in a room for 15 minutes

💯 When mo-mo turn to no-no (with no valuation support), get out the way!

Quality bros love getting interested when it’s 10% cheaper but end up in shambles when it gets there and moves down another 20% and still trades at mid 20s and decelerating top line starts to show.

Constellation Software $CSU.TO has a subgroup called “Acquire”. How apropos! 🤣

Watchlist of "future $CSU's" - Lumine Group - FOG Software - Juniper Group - Modaxo - Datamine - Sygnity - Aquila - Carina - Acquire - Vesta Software - Vencora - Trapeze Group ...I'm missing some here

Saw my first $TSLA semi truck / 18 wheeler today… granted it was from the parking lot of a Tesla service center so

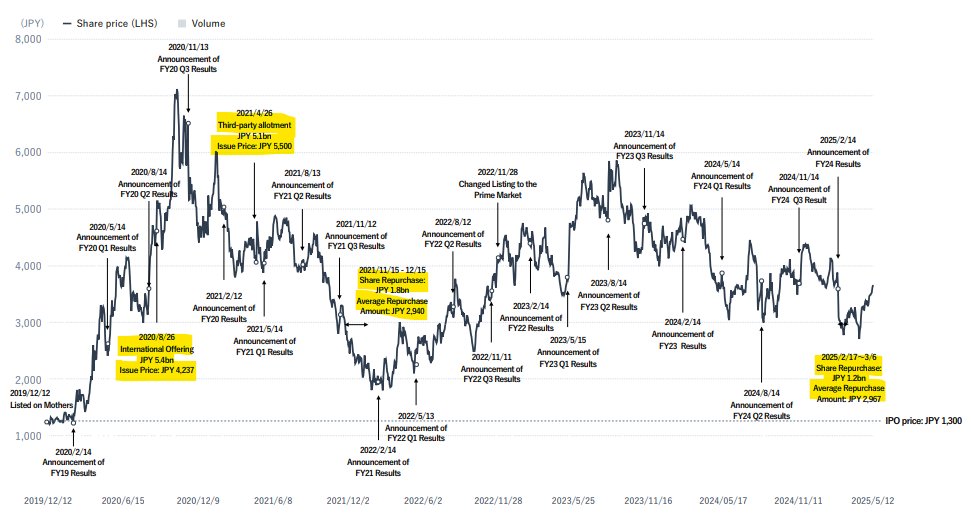

I wish more companies would provide a chart like this showing equity issuance & buybacks vs. stock price - Medley's $4480.JP done a pretty good job.

More money has been lost not averaging up because of wanting the lowest avg cost basis… seen it so many times in my career (unfortunately I’m guilty of it too!)

I have a few stocks in my portfolio for which I am fairly certain I have the lowest avg cost on, globally. It strokes my ego so badly I am guaranteed to make suboptimal decisions on them.

That feeling you get when a stock that's been on your watch list forever finally gets to an attractive price... only to realize that's because they did a 5:1 split recently 🤣🤦♂️ Bufab $BUFAB.ST

I'm biased being a $CSU.TO shareholder but I have a hard time understanding the M&A math at VitalHub $VHI.TO unless it's solely multiple arbitrage. Latest acquisition at 4.1x ARR - even if they grow it 20% and boost EBITA margins from neg. to +22% the ROIC is still only ~5%.

To be clear, this PM had a well-defined process (he was very transparent with the types of stocks he might be interested in) just that industry participants should put more weight on outcomes. “I outperformed by 500bps” > “I underperformed but my process is good”

One of the best PMs I know (runs a >$100B fund) basically believes the opposite - should focus much more on outcome and less on process

One of the best PMs I know (runs a >$100B fund) basically believes the opposite - should focus much more on outcome and less on process

"Process matters more than outcome. If you follow a good process, the outcome will eventually take care of itself." - Michael Mauboussin