Brian Cubellis

@BackslashBTC

Chief Strategy Officer @OnrampBitcoin \\\\\\\\ Partner @Early_Riders

What is @OnrampBitcoin? Your ‘private-banking-like’ bitcoin-native ‘onramp’ to a serious long-term solution for your savings. Bespoke & dedicated client service + Best-in-class multi-institution custody (customizable, enterprise-grade, fault-tolerant, no single point of…

"This is another convergence of these accelerating technological disruptions that are going to have cascading impacts on our monetary paradigm... ...there's a strong positive loop between AI & bitcoin." [@matthew_pines on The Last Trade]

Fault tolerant setups are important

Bitcoin empowers individuals to hold wealth directly—but that creates real-world security risks. Onramp CEO @MTanguma discusses why material holdings require fault-tolerant custody models that minimize reliance on any single person or entity. [@stephanlivera]

Suitcoiners, Spitecoiners, and the New Bitcoin Buyer "ETFs have attracted a more stable, risk-aware investor base, including financial advisors, RIAs, and thoughtful retail investors, who are adding Bitcoin as a long-term, asymmetric investment. “Spitecoiners” buy Bitcoin not…

Thanks @manwithpurpose_ - this might have been my favorite TLT episode yet. @EricBalchunas was gracious with his time and open to the dialogue around why Coinbase holding an increasing amount of BTC might not be the best thing for Bitcoin. It's why @OnrampBitcoin was founded.…

Great rip 🔥 youtu.be/41Qi1RKVuZ4?fe… @EricBalchunas connecting the dots on custody in real time! Well done @MTanguma and team! You should bring him back on or have the Blackrock and Coinbase guys on!

New episode of The Last Trade, out now! @EricBalchunas , Senior ETF Analyst for @business , joins to discuss… ➤ IBIT, the fastest-growing ETF…ever ➤ Why Larry Fink became bitcoin’s biggest ally ➤ How ETFs bring legitimacy & access ➤ Bitcoin's uniquely sound nature ➤…

Gold, real estate, and fine art hedge against debasement—but access is costly, illiquid, and exclusive. Bitcoin is a democratized hard asset: finite, permissionless, digital, and global. @EricBalchunas of @Bloomberg explains on The Last Trade.

Regulatory ambiguity around “Qualified Custodians” misses the broader point. Bitcoin enables protocol-native custody models that are fundamentally more secure by design. @zackbshapiro of @btcpolicyorg breaks down why this is relevant for policymakers on The Last Trade 👇

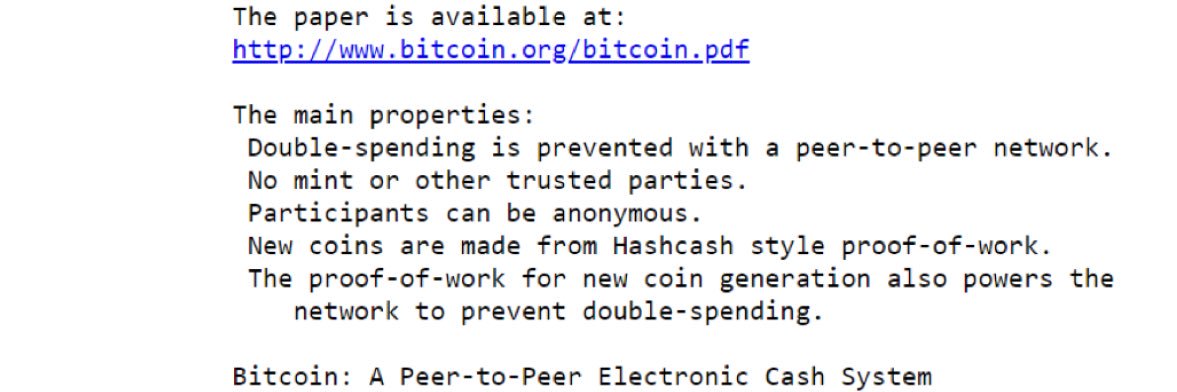

“It is well enough that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” —Henry Ford Over a century ago, Henry Ford proposed replacing gold with an energy-backed…

The real "Last Trade"—printing dollars to buy BTC—isn’t an option for states. That constraint makes the case for state-level Strategic Bitcoin Reserves even stronger and more urgent. @zackbshapiro of @btcpolicyorg breaks it down 👇

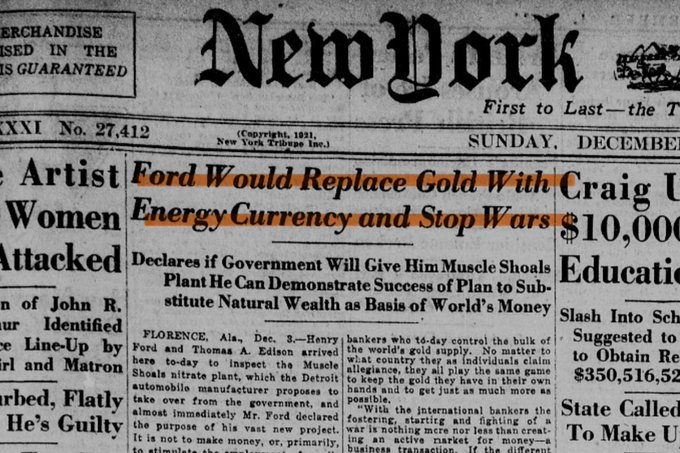

Bitcoin has no central issuer. It can't be debased. It's borderless. @intangiblecoins explains why it's the perfect strategic reserve asset—credibly neutral, finite, and built for global portability.

We know liquidity drives Bitcoin. But it’s not just about dollars, it’s about access. ETFs opened the floodgates. Trillions can now flow into BTC. Most successful ETF launch ever. And we’re just getting started. @real_vijay on The Last Trade

Bitcoin ETFs? Probably nothing. • $150B+ AUM • IBIT hit $80B in 341 days—fastest ever • Top 20 U.S. ETF, youngest by 12+ years • BlackRock’s most profitable ETF • 1,000+ institutions hold IBIT Thanks for coming on, @EricBalchunas! BTW favorite cheesesteak spot?

Decentralized, secure, finite. @EricBalchunas, Senior ETF Analyst for @Bloomberg, describes his journey to understanding bitcoin's unique nature as digital sound money. This week on The Last Trade 👇

New episode of The Last Trade, out now! @EricBalchunas, Senior ETF Analyst for @Bloomberg, joins to discuss… ➤ IBIT, the fastest-growing ETF…ever ➤ Why Larry Fink became bitcoin’s biggest ally ➤ How ETFs bring legitimacy & access ➤ Bitcoin's uniquely sound nature & more!

Cold storage. Segregated vaults. Verifiable on-chain. Onramp democratizes institutional-grade multisig custody—distributed across independent institutions. No keys to manage. No single point of failure. Peace of mind, without complexity. [@MTanguma]

The debt is just getting started... So maybe the price isn’t that high after all Had a fun rip with @EricBalchunas Btw NOT a boomer or a suitcoiner Thanks for coming on, Eric Also forgot to ask, what’s your favorite cheesesteak in Philly?

Multi-institution custody redefines control. Clients own the vault and initiate all movement. Independent keyholders act only at the client’s direction. No single keyholder has unilateral control. One failure doesn’t break the system. That’s fault tolerance. That’s Onramp.

The biggest risk to Bitcoin has been the state. That risk is now off the table. 🇺🇸The U.S. political establishment is now pro-Bitcoin 📈Trump Media is now the 6th-largest corporate BTC holder 🌬️Political headwinds are now major tailwinds The Last Trade w/ @real_vijay

"You can't trade Apple stock 100,000 times on a Saturday afternoon. You can't vibrate it at a high frequency, you can't self-custody, you can't program it." — @saylor What happens when everyone realizes that digital capital is smarter, faster, stronger, universal?