Barry Eichengreen

@B_Eichengreen

George C. Pardee and Helen N. Pardee Professor of Economics and Political Science, University of California, Berkeley, NBER Research Associate, CEPR Res Fellow

Somewhat longer version of "Can the Dollar Remain King?" online, with graphics: ft.com/content/8a71dc…

American Exceptionalism Meets its Maker: msn.com/en-xl/money/to…

Meant to write "we're able to link individual agents'/wallets' bets..."

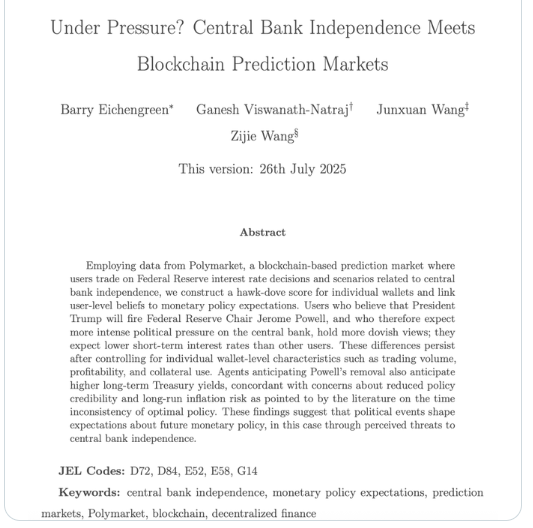

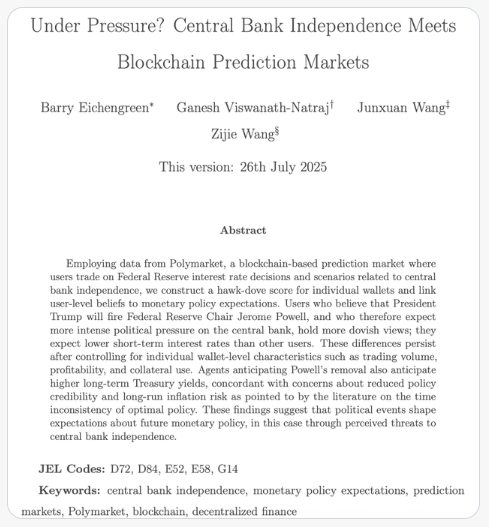

Using data from Polymarket, we're able to individual agents'/wallets' bets on different contracts: Powell's firing, the outcome of the next FOMC meeting, and expectations of 10-year Treasury yields, inflation and recession risk. papers.ssrn.com/sol3/papers.cf…

The analysis thus suggests (personal view) that a president who wants a monetary policy that fosters expectations of low 10-year yields and an expanding economy best withholds his social media posts and lets the FOMC do its job. papers.ssrn.com/sol3/papers.cf…

Analysis of Polymarket data suggests that a bet on "Powell out" increases the likelihood of a bet on an interest cut at the next FOMC meeting ("the revenge of time inconsistency"). But it also leads to higher expected 10-year Treasury yields and greater recession risk.

Using data from Polymarket, we're able to individual agents'/wallets' bets on different contracts: Powell's firing, the outcome of the next FOMC meeting, and expectations of 10-year Treasury yields, inflation and recession risk. papers.ssrn.com/sol3/papers.cf…

Ganesh has a nice thread explaining in more detail what we do and how we do it.

1/5 Can political threats to central bank independence shift investor expectations in real time? Excited to share a new paper with @B_Eichengreen, @Junxuan_Wang_, and Zijie Wang using blockchain-based data from Polymarket. A short thread 👇 📄 papers.ssrn.com/sol3/papers.cf…

Do Trump's threats to fire Chair Powell damage central bank independence and diminish the credibility of monetary policy? Our new paper (w/ Ganesh Viswanath Natraj, Junxuan Wang and Zijie Wang) shows that the answer is yes. papers.ssrn.com/sol3/papers.cf…

.

𝔼𝕚𝕔𝕙𝕖𝕟𝕘𝕣𝕖𝕖𝕟 & 𝕊𝕒𝕜𝕒 (𝟚𝟘𝟚𝟝) 𝔹𝕚𝕝𝕒𝕥𝕖𝕣𝕒𝕝 𝕋𝕣𝕦𝕤𝕥 𝔻𝕒𝕥𝕒𝕓𝕒𝕤𝕖 sites.google.com/site/orkunsaka… Int. economics/finance scholars obsessed with dyadic relationships and gravity estimations: check this brand new dataset from our @JEEA_News paper w\@B_Eichengreen

Podcast on the past and future of the dollar in the global economy: vip.udn.com/vip/story/1222…

.

I generally agree with the distinguished economic historian Barry Eichengreen. But I think he is a bit too pessimistic here -- the euro has its limits, but I suspect it would work reasonably well as a vehicle currency that lubricates global trade and finance 1/

.

.@UCBerkeley's @B_Eichengreen observes that whereas US and German fiscal strategies both imply larger budget deficits and higher government debt, the similarities end there. bit.ly/44n2wrx

.

Germans know the difference between relaxing budgetary austerity for good reasons, such as security and long-term growth, and abandoning all fiscal common sense. Sadly, Trump’s America does not, writes @UCBerkeley's @B_Eichengreen. bit.ly/44n2wrx

"A Tale of Two Budgets" project-syndicate.org/commentary/us-…