BVNK

@BVNKFinance

Accelerating global money movement. BVNK builds enterprise-grade payments infrastructure for stablecoins.

$15bn+ in stablecoin volumes has taught us what works. Now you can see for yourself with our free guide and interactive demos. • Test-drive stablecoin flows (no coding) • Get intel on pricing • Compare compliance approaches • Understand delivery options • Avoid common…

"You can't ride a bike by looking at it." 🚴 In this clip from July's Currency LIVE, BVNK's @chrisharmse89 speaks with @renemichau, Global Head of Digital Assets at Standard Chartered about their hands-on approach to digital assets What's driving their strategy? "Pretty much…

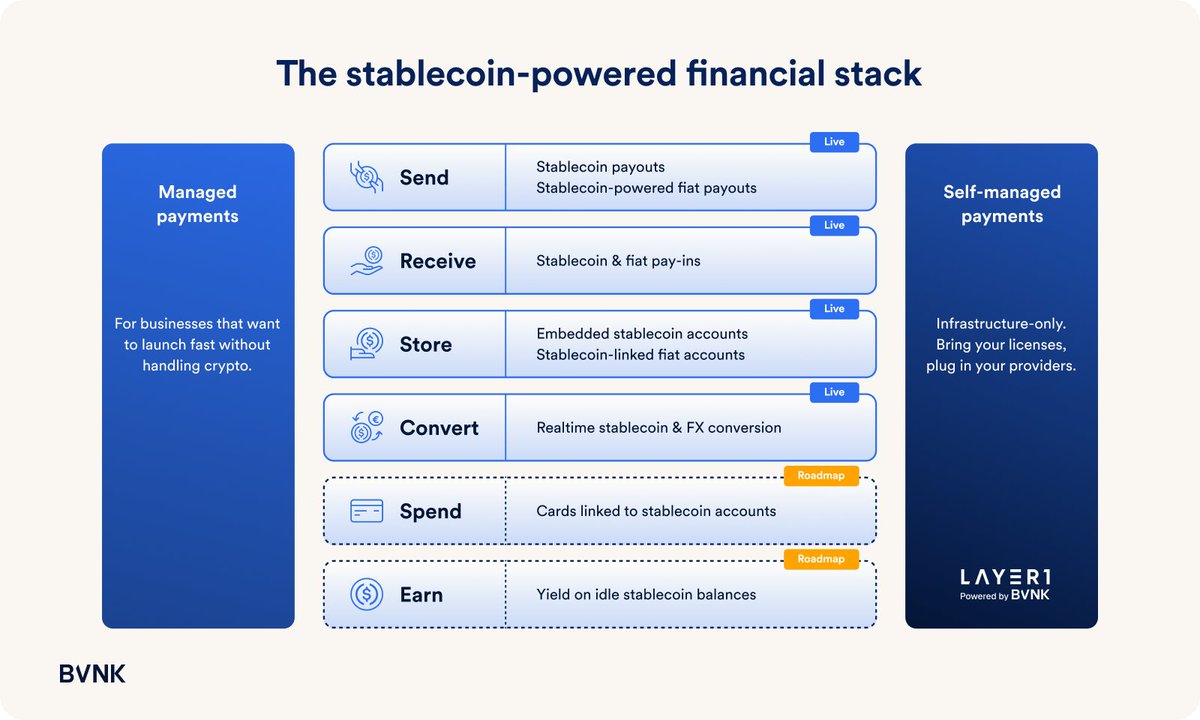

6 exchanges, 12 chains, 3 spreadsheets, endless alerts... This isn't just payment ops complexity – it's a competitive disadvantage. In this video, Product Manager Paddy Howell-Day explains how our self-serve stablecoin infrastructure, Layer1, helps organisations manage…

New analysis from @FXCintelligence sizes the stablecoin market opportunity at $16.5-23.7 trillion for cross-border payments. Key insights: • B2B represents the largest opportunity segment • Key corridors: Latin America to North America, and Sub-Saharan Africa to Europe &…

.@StanChart just became the first systemically important bank to launch spot crypto trading. In our chat with Digital Assets Head @renemichau last week, we discussed why early bank blockchain initiatives failed: lack of "cash in the network". Watch the full conversation:…

Bitwave x BVNK: Enterprise finance meets real-time payments. We’ve partnered with @BVNKFinance to help businesses move between fiat and stablecoin payments—securely, compliantly, and with complete control. 🔗 Read more: bitwave.io/blog/bvnk-bitw…

Banks: what's the smart move on digital assets? x.com/i/broadcasts/1…

⏰ Starting in 20 minutes ⏰ Join us LIVE here on X for a conversation on the digital asset playbook for banks with BVNK's @chrisharmse89 and @StanChart's @renemichau . Don't miss this insider discussion on how traditional banks are approaching the stablecoin opportunity.

Finance is facing a shift as big as telecom's analog-to-digital leap. Just as digital networks turned copper wires into light-speed data highways, stablecoins are rewiring global finance. At BVNK, we're building the infrastructure for this new era. Our goal: enabling value to…

Yieldcoins: Money That Pays Nick Carmi, Head of Exchange @FigureMarkets @armandkhatri, Head of Ecosystem @OndoFinance @jelena_noble, Co-Founder & CEO @noble_xyz @TylerSherwin, VP Sales @BVNKFinance

“50% of our TPV is B2B payments” @chrisharmse89, CBO and Co-Founder of @BVNKFinance, says that corporate treasury management is still the killer use case for big corporates like Amazon or Walmart, rather than rushing to issue their own Stablecoin. 🎙️ Listen to the latest…

The banker’s digital asset playbook 📘 Stablecoins or tokens? Public or private blockchains? Banks face critical choices in digital assets: few have navigated this terrain as deliberately as Standard Chartered Join us LIVE on X and Linkedin next Friday 11 as BVNK's…

Cross-border #payments in #emergingmarkets face slow settlement and high costs. With @BVNKFinance, we’re turning #stablecoin transfers into local payouts across 40+ markets — fast, compliant, and at scale. Full PR: hubs.ly/Q03tkcJC0 #OnedLocal #Stablecoins #Payouts

Excited to expand our partnership with Nasdaq-listed @dLocalPayments🤝 What started as a treasury use case has evolved into a new model for merchant funding and global payouts. Using BVNK’s infrastructure, dLocal is accelerating cross-border payments for its merchants.…

Stablecoins play two key roles: 1️⃣ Payment rail – fast, borderless transfers 2️⃣ Payment method – acts like a credit card or PayPal, seamlessly embedded into checkouts @BVNKFinance's @chrisharmse89 says knowing the difference helps businesses pick the right use case.