Axel 💎🙌 Adler Jr

@AxelAdlerJr

FREE daily on-chain & macro #Bitcoin research from a Verified Author @CryptoQuant 👀. Get your weekly market report & original deep-dives 👇

💡Insight #54 is live: Bitcoin consolidates: momentum cooling, institutional and corporate demand steady at +227K BTC, key support level $115K and window for testing $122–$125K 🙌 Get the full breakdown in my latest report. adlerscryptoinsights.substack.com/p/bitcoin-tren…

First, it’s premature to declare the death of the four‑year cycles the current cycle simply hasn’t ended yet. Second, in most cases BTC’s price movement is driven by futures-position pressure and you should also account for the impact of short‑term holders, whose peak selling…

Why is the four-year cycle dead? 1) The forces that have created prior four-year cycles are weaker: i) The halving is half as important every four years; ii) The interest rate cycle is positive for crypto, not negative (as it was in 2018 and 2022); iii) Blow-up risk is…

The week is coming to an end and in this bull cycle, only 12 weeks have shown the same or greater selling pressure from the bears, which accounts for about 7.3% of the entire cycle. Therefore this week is among the 7% most extreme in terms of selling volume, yet the price has…

Coinciding with today's large transfer of Bitcoin, Binance, Bybit and Gate have seen a sharp increase in open interest in the last 24h, ~$4 billion. This mean shorts jumped in. Binance and Bybit received an important chunk of the coins transferred today.

The ECB has kept its key interest rate steady at 2.00%, in line with market expectations. Inflation is at the 2% medium‑term target, price pressures are easing, and wage growth has slowed. In the press conference, President Christine Lagarde described the stance as…

The net realized profit/loss chart clearly shows strong spikes of profit-taking by investors during price growth phases. There's a high probability we'll see one or two more waves of profit-taking before the price enters a deeper correction. Each such wave will be accompanied…

The chart shows that over the last quarter, the maximum price 'drops' on the 5-minute timeframe reached -10% in early June and -12% in mid-month, while the average weekly drawdown (green line) holds at 3.8%. The current pullback of -6% is within normal volatility range, being…

This became one of the catalysts and until yesterday the market was calmly absorbing these volumes.

80K $BTC in Motion: Is Galaxy Digital Pulling the Trigger? 📉 Let’s dive in: 🧵 ⤵️ 1️⃣ On 4 Jul a dormant Satoshi-era wallet re-awakened, starting to move its entire 80,202 BTC to Galaxy Digital’s trading desk. 2️⃣ 15 Jul — First tranche 9,000 BTC arrives at Galaxy; within hours…

Asian equity markets are declining as investors assessed the implications of the newly signed U.S. - Japan trade agreement and awaited progress in other major negotiations. U.S. and Chinese officials plan to meet in Stockholm next week, with China facing an August 12 deadline…

At present, the futures net position (OI Net Position) has plunged into deep negative territory, breaching the $100 million mark (the highest level of bearish pressure since early July). Despite this, BTC is holding around $115K, indicating that buyers are partly absorbing the…

The anticipated launch of China’s yuan‑backed stablecoins for a broad audience could lead to Bitcoin legalization and spur new demand Chinese households’ net wealth ($85 trillion, about half that of the U.S.) could drive significant additional uptake.

An anomalously high Monthly CDD / Yearly CDD ratio of 0.25 is being observed in the market at prices in the $106 K–$118 K range, which is comparable to the historical peaks of 2014 and the correction of 2019. This means that long‑term holders (LTH), who have kept their…

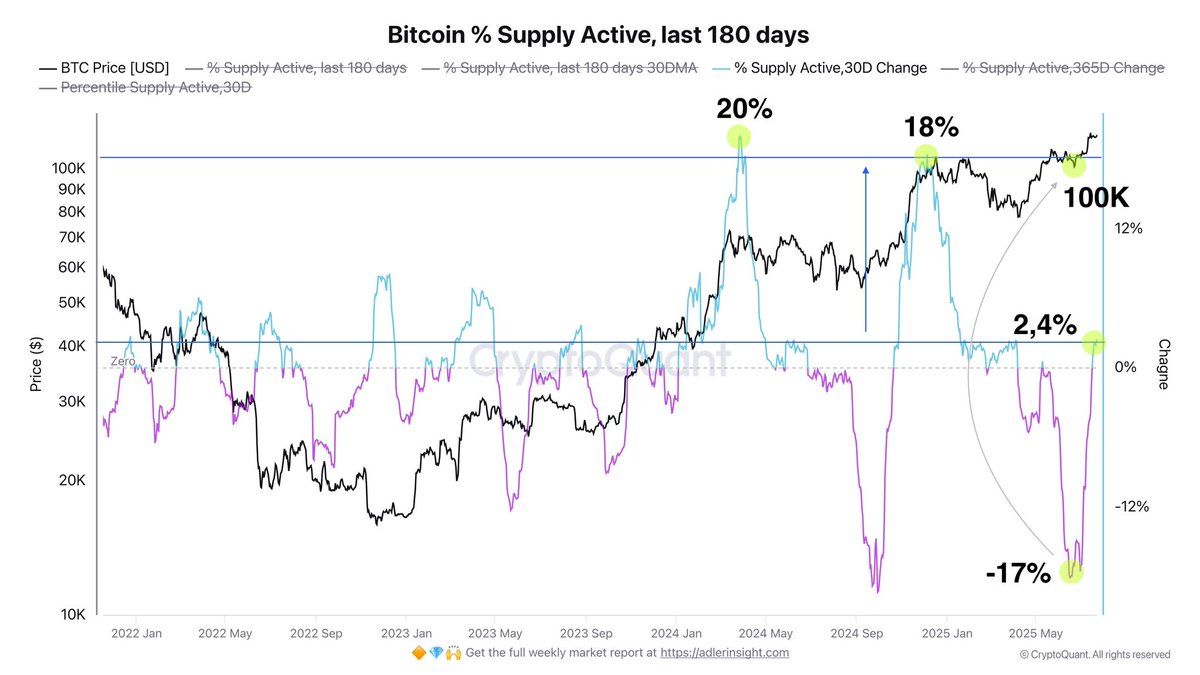

The share of coins active over the last 180 days (% Supply Active) sharply increased twice in past macro cycles: first to 20 % when BTC climbed to $70,000 in spring 2024, and then in December 2024 to 18 % upon the first breach of the psychological $100,000 mark. This…

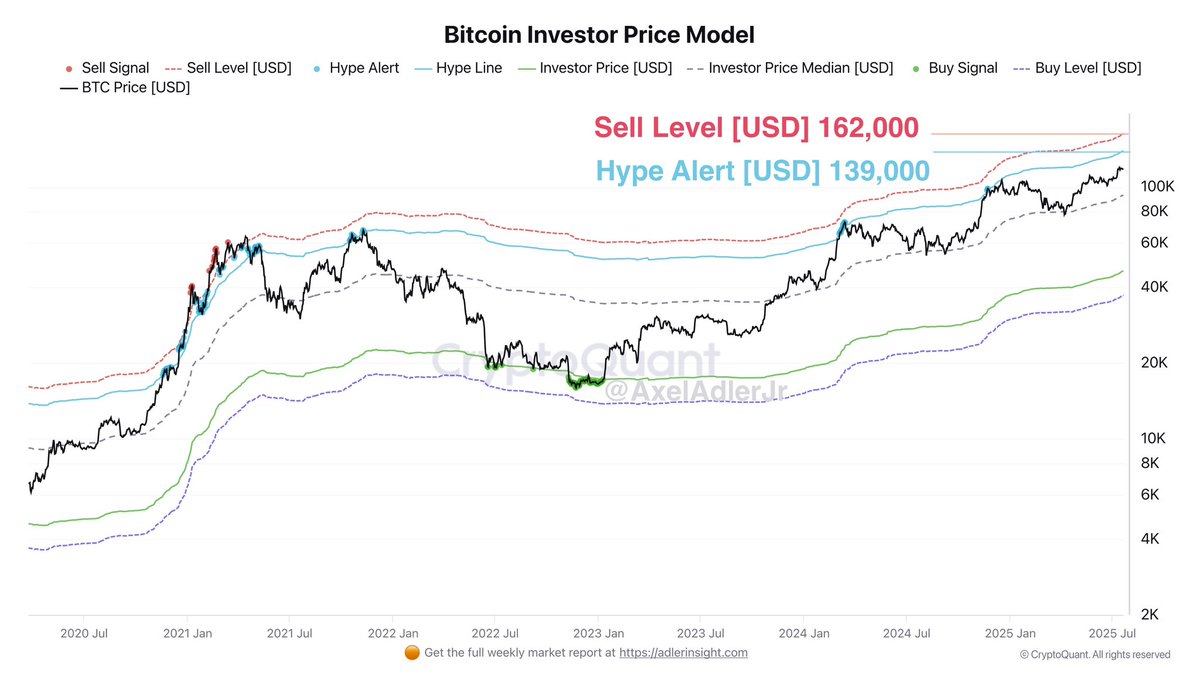

As of today’s price of $117 K, Bitcoin is in the growth zone between the Investor Price Median ($92 K) and the Hype Alert level ($139 K). This suggests that buying activity is still supported by market participants: they’re willing to hold or add to their positions as long…

The market is dominated by bullish sentiment, but the bulls lack aggression.

💡Insight #53 is live: Bitcoin consolidates at $118K level: institutional flows, reduced inflows and macro "window" set the stage for testing $125–130K 🙌 Get the full breakdown in my latest report. adlerscryptoinsights.substack.com/p/bitcoin-tren…

The 30‑day moving average of the Fear and Greed Index has climbed back into the optimism zone, currently sitting at 66%. Market sentiment remains broadly greedy, but we have yet to hit the extreme 75–80% threshold that coincided with local highs in March and December 2024. Bulls…

House passed the Digital Asset Market Clarity Act (H.R. 3633) and the Anti‑CBDC Surveillance State Act (H.R. 1919) on July 17, both now await Senate review. The GENIUS Act (S. 1582) has cleared both chambers and is on the President’s desk for signature. Sources:…

🎉Big milestone for Bitcoin. The network’s Realised Cap has surpassed $1 trillion for the first time a new all‑time high. Unlike simple market capitalization Realised Cap sums the value of each coin at the time of its last transaction, providing a more realistic picture of the…

Over the past 24 hours, the futures market saw two large spikes in short‑position closures $540M and then $460M, totaling $1B.