┻┳ S. ArchΞr

@Archer_MD_

Engineer by choice, writer by passion, and full-time gambler by heart. DeFi Research. @tokemakXYZ

The L1 premium will die, and apps will rise, the fallacy is including ETH in this category

Guess what happens if/when Lubin decides to plow SBET's ETH into lending on Aave's Linea deployment, providing the best capacity to lev. stake in size Not fading Linea, he's locked in

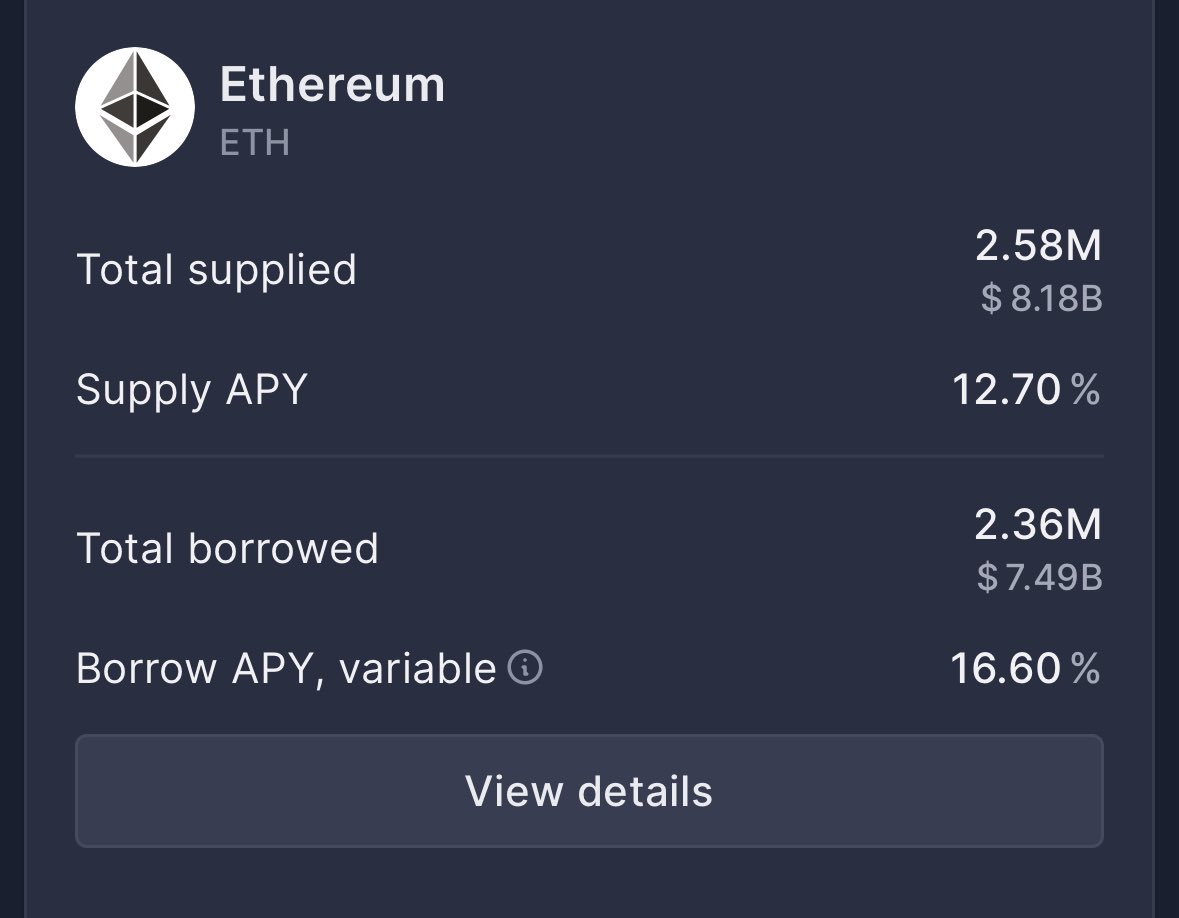

ETH leveraged staking right now: > ETH borrow rates spike on Aave > Lev. staking running at a loss > Aave adjusts IR curve to lower borrow rates > Rates once again in the red for lev. staking > Small spike in exit queue > Slight stETH discount (prob lev. unwinding to repay ETH)

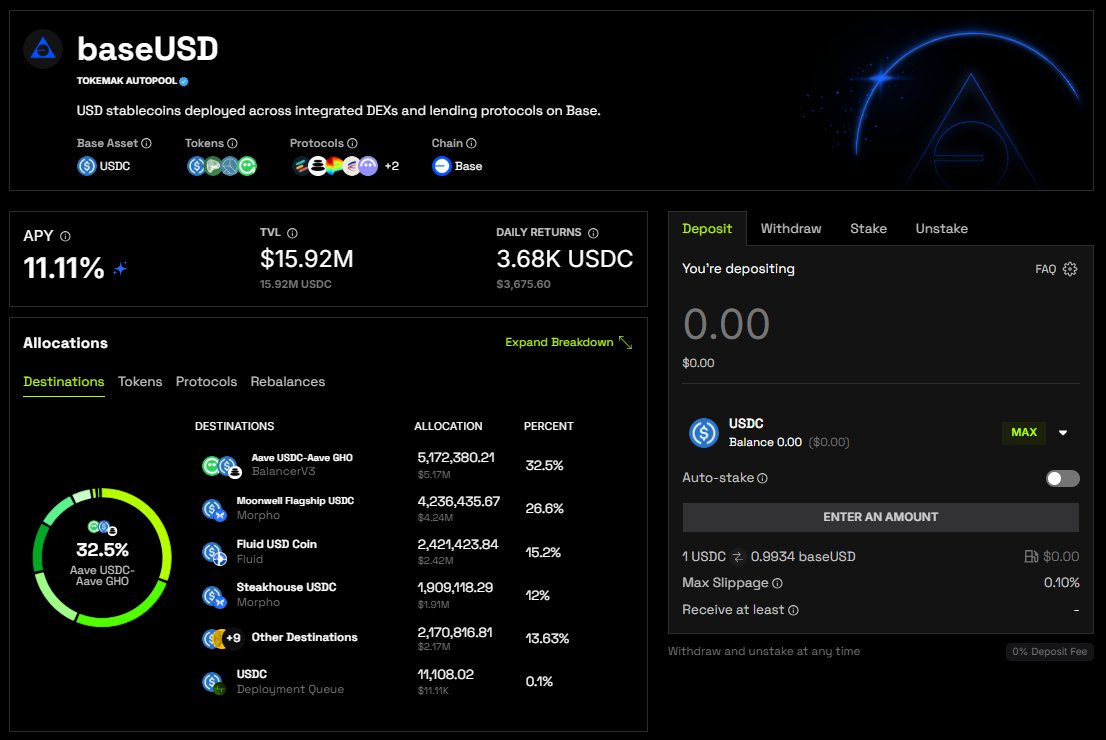

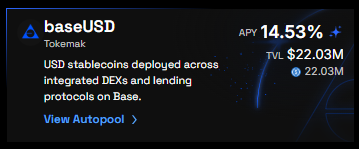

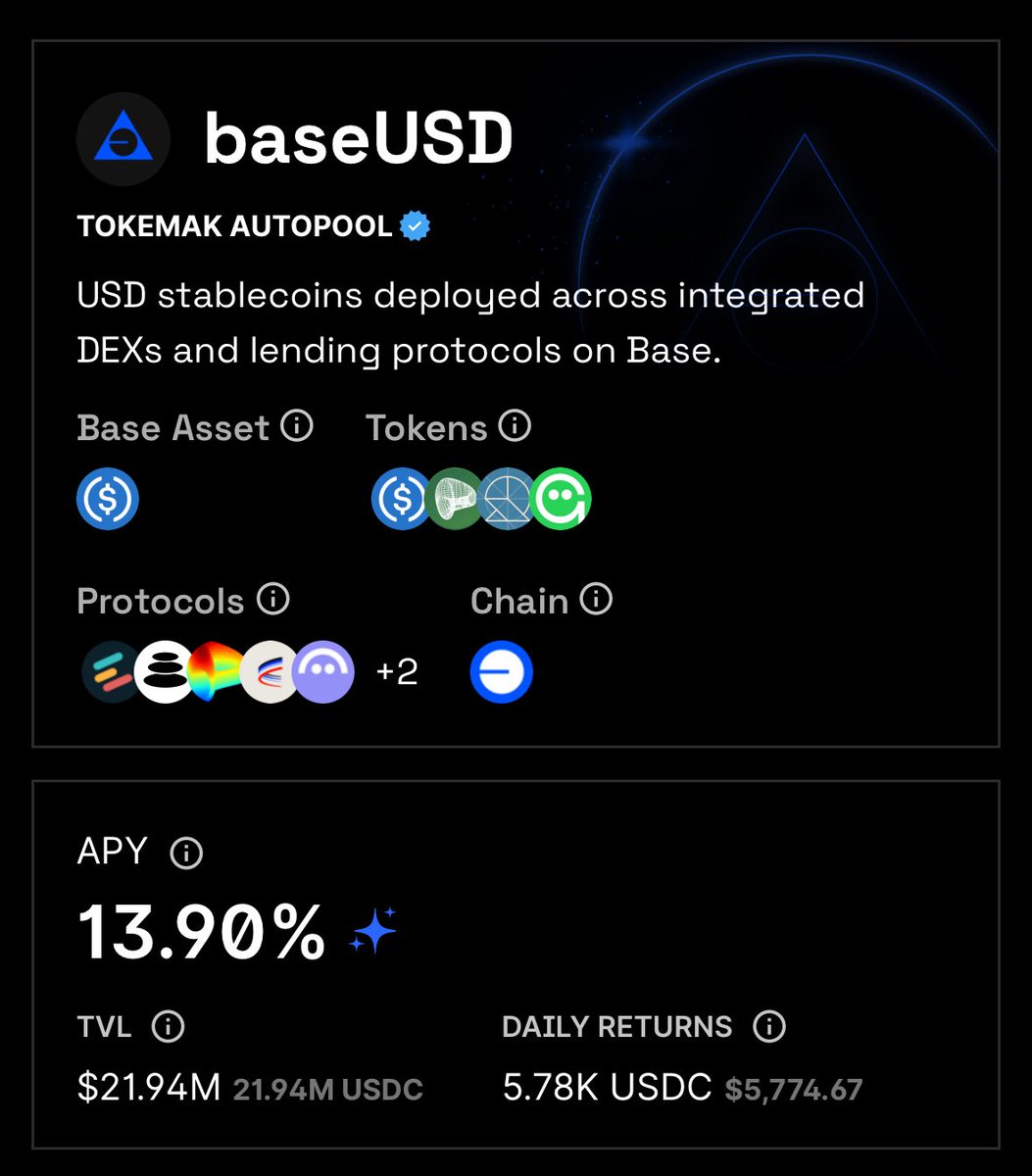

baseUSD earning ~14% with an AUM of $22M This is the best way to put your USDC to work on @base with size

ETH leveraged staking right now: > ETH borrow rates spike on Aave > Lev. staking running at a loss > Aave adjusts IR curve to lower borrow rates > Rates once again in the red for lev. staking > Small spike in exit queue > Slight stETH discount (prob lev. unwinding to repay ETH)

Infinite bid

JUST IN: 🇺🇸 President Trump to open the $9 trillion US retirement market to crypto investments, FT reports.

ETH supply APY @ 12.7% - for the sake of leveraged stakers supply your ETH to bring utilisation rates down

With the next planned launches and consumer app that we're working on I expect that Autopilot will cross $100M in AUM during Q3 manifesting

$17M MC with a $17M treasury and $87M TVL in their new automated yield products that are growing across Mainnet, Base, and Sonic Buyback and distribute tokenomics with protocol revenue is active for stakers Fully circulating supply It might just be that simple for $TOKE

Autopools are a tool that can be used to streamline liquidity across entire ecosystems plasmaUSD, on Autopilot soon

Asking why price is up/down is the best way to doxx yourself as a pleb Price precedes narrative, not the other way around

Yield-bearing stablecoins are money market funds in the 70s You’re not bullish enough

A staggering $7.4 Trillion is now sitting in Money Market Funds, a new all-time high 🚨🚨

Ethereum = tokenization Attempts to elaborate a better narrative are absurd, based Tom Lee

$ETH = tokenizing real world Starting with stablecoins

Great point @Matt_Hougan ‼️ Stablecoins, the “chatGPT” of crypto, basically are USD tokenized - @RobinhoodApp leading push to tokenize equities and other assets - vast majority of “real world assets” are on the ethereum blockchain Positive for $ETH @ethereumJoseph…

Flows into Ethereum ETFs are going to accelerate significantly in H2. The combination of stablecoins & stocks moving over Ethereum is an easy-to-grasp narrative for traditional investors. ETH ETFs did $1.17. billion in flows in June. They could do $10b in H2.

baseUSD standing out for its growth on @base as the best automated solution for yield on USDC small pause to add a bunch of integrations, next leg up in TVL is nigh

Leading Base Protocols in Growth This Week: 💰 Total Value Locked ▫️ @rollxfi – $32.41m (+11,973%) ▫️ @SushiSwap – $10.35m (+277%) ▫️ @wasabi_protocol – $1.34m (+52.88%) ▫️ @SteakhouseFi – $13.66m (+26.68%) ▫️ @TokemakXYZ – $18.48m (+23.19%) ▫️ @GainsNetwork_io – $3.89m…

Prediction markets, rather than sentiment markets, are a fumble comparable to decentralized finance rather than onchain finance.

baseUSD just keeps growing at it's now @ ~$16M earning 11.11% The base rate alone is 8.4% in cold hard USDC More Autopools coming soon