AngelList

@AngelList

Building the infrastructure that powers the startup economy. 🚀 Venture & Rolling Funds 🌐 Scout Funds ⚡ SPVs 💻 Digital Subscriptions 🧠 AI Tools (beta)

AngelList isn’t a job board or SPV-only shop anymore. Since 2019, we’ve been building the infrastructure for modern venture. Today, funds of all sizes—not just angels—use us to launch, raise & scale. @avlok breaks it down on @tbpn 👇 youtube.com/live/ogDhBUa81…

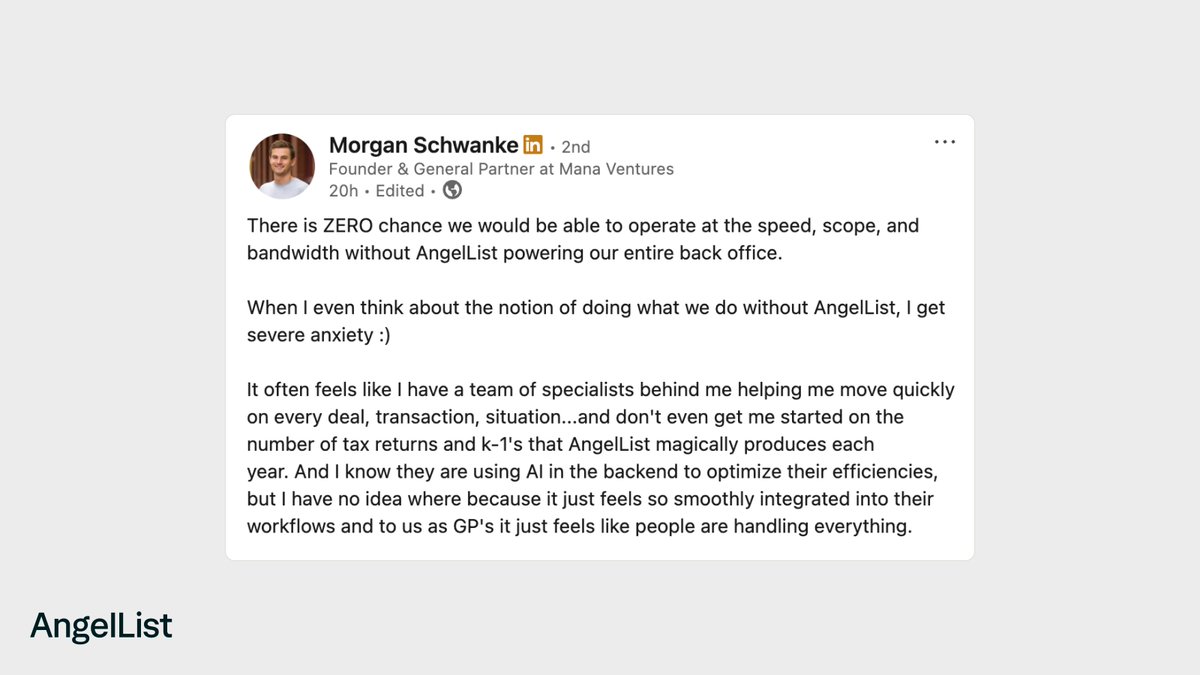

"It often feels like I have a team of specialists behind me helping me move quickly on every deal, transaction, situation." Thank you for trusting us with your back office fund ops @MorganSchwanke! 🤝

.@SophiaBush keeping it real: $10K can get you into angel investing thanks to platforms like AngelList. We make startup investing accessible to those who are interested, not just those w/ deep pockets. When more people can back ideas they believe in, society wins. 🎥: The…

AngelList stopped supporting multi-layered SPVs a while ago. Predatory economics + hard to vet the underlying ownership. This hurt our bottom line. But, LP & founder trust is more important than our bottom line.

This shit needs to be outlawed.

"As much as they're interviewing you, you're interviewing them." @Marell_Evans (@ExceptionalCap) and @RossRobinson (@UWVelocity) share their playbooks for raising from ILPs. Dig into the full conversation & key takeaways: angellist.com/blog/winning-i…

Congrats to @RexSalisbury on raising @Cambrian_HQ's second fund at $20M! Rex is building on Fund I's incredible track record: 50% of portfolio companies already secured Series A (vs. 15.4% industry average). Rex raised Cambrian's Fund II on AngelList.🤝techcrunch.com/2025/07/16/rex…

Capital → GPs → Founders → Innovation 🚀 AngelList powers this cycle at every stage, starting at the very beginning with fund formation. We're proud to be named in @CNBC & @StatistaCharts World's Top Fintech Companies. cnbc.com/the-worlds-top……

From $1B to $171B+ AUM in 5 years. Our CEO @avlok caught up w/ @LexSokolin & broke down AngelList's evolution from angel investor list + talent platform (now @WellfoundHQ) → go-to fintech platform for GPs launching & scaling funds of all sizes. 🎧 ▶️👇 podcasts.apple.com/us/podcast/ins…

📣 Sarah Smith Fund I is closed at $16.1M! After 20+ yrs at FB, Quora, & top VC firms, Sarah’s backing “irrationally intense” founder-CEOs with $250K checks. Her fund is powered by AI, and she runs it on AngelList. More via @nmasc_👇 theinformation.com/articles/one-n…

7/9 @ 3:36pm - GP contacts their dedicated IR POC for more info about AngelList-advised fund structure. 7/9 @ 4:25pm - AngelList IR responds to GP with a promise to revert first thing in the AM. 7/10 @ 7:30am - AngelList IR responds. 7/10 @ 7:36am - 🔥

No two institutional LPs are the same, but they all care about one thing: data. GPs who’ve raised ILP capital on AngelList say: → Organize your data early → Move with urgency → Tailor your approach (FoFs ≠ family offices) 🎥 @RossRobinson (@uwvelocity) breaks it down.

We’re hiring a Sr. SW Engineer (DevOps) to architect the infra behind $124B+ in venture assets. You’ll scale systems powering billions & redefine how founders and investors connect. Join the small, fast-moving team behind every product we build. Apply 👇 angellist.com/careers/78bbf4…

Early-stage comeback is more than just vibes, and we have Q2 data to back it. LP capital into funds up 43% QoQ. Valuations rebounded w/ Series B up ~40%. Capital allocators are betting on early-stage funds again. @avlok broke it down w/ @jordihays & @johncoogan on @tbpn.

.@avlok (CEO of AngelList) on the surge of LP interest in emerging managers and why Q2 felt like a turning point. “We just hit the perfect storm in Q2; big exits, real revenue growth, and massive dollars flowing back to LPs." "LP investment into emerging managers, funds…

You know you've made it when you get the foghorn + gong treatment on @tbpn. #IYKYK Thanks for having @avlok on the show @johncoogan @jordihays 👊