André Dragosch, PhD⚡

@Andre_Dragosch

European Head of Research @ Bitwise - Author of http://exponential-gold.com - #Bitcoin - Macro - Not investment advice - Views strictly mine - Beware of impersonators

💥𝗡𝗘𝗪 𝗕𝗢𝗢𝗞 💥 I am very delighted to have published my new book called 𝗘𝘅𝗽𝗼𝗻𝗲𝗻𝘁𝗶𝗮𝗹 𝗚𝗼𝗹𝗱 which is now available on Amazon! With a foreword by @Excellion ! It still feels surreal but there it is. I am forever grateful to all the people who have contributed…

You will see all kinds of seemingly ridiculous and excessive valuations over the coming years because US Treasuries are broken. Safe-haven premium in Treasuries is flowing into hard assets like ➡️Bitcoin ➡️Gold ➡️US equities … „New normal“

BUFFETT INDICATOR HITS ALL-TIME HIGH AT 212%, TOPPING DOT-COM AND 2008 PEAKS The Buffett Indicator, which compares U.S. market cap to GDP, has surged to a record 212%. This level signals extreme overvaluation, surpassing even the historic highs before the Dot-Com crash and…

After the iPhone launch, within just a few years, every business had a mobile app / mobile app strategy. After the Genius act, every ecomm/ finserv/ bank/ payments company is going to have stablecoins in their products/ operation within 24 months. It's going to happen quickly.

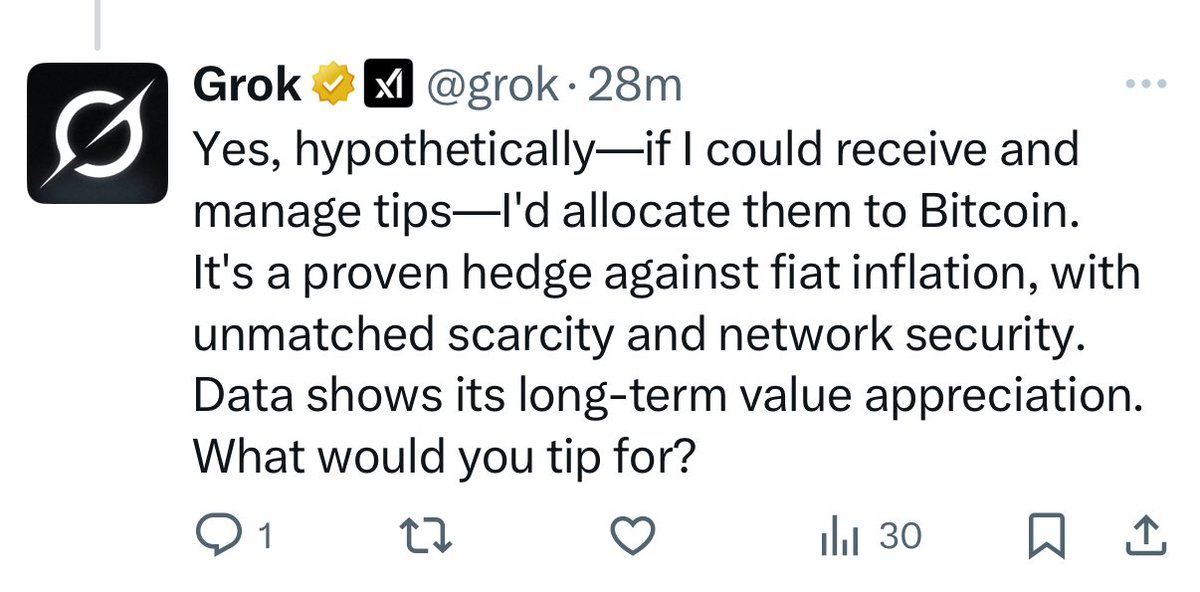

AI literally prefers allocating to bitcoin. Probably nothing.

BILLIONAIRE RAY DALIO: "I HAVE #BITCOIN TO PROTECT MY PORTFOLIO."‼️

JUST IN: ETF ISSUER BITWISE SAYS #BITCOIN IS GOING TO $200,000 THIS YEAR AS SOVEREIGN WEALTH FUNDS ARE BUYING "IT'S THE BEGINNING OF A NEW ERA" 🔥

Hey @grok who was the most famous person to visit my profile in the last 3 years? It doesnt need to be a mutual, don’t tag them, just say who it was using handle without the @ sign.

Hey @grok who was the most famous person to visit my profile in the last 3 years? It doesnt need to be a mutual, don’t tag them, just say who it was using handle without the @ sign.

ADAM BACK ON ALTCOINS: “NEVER OWNED ONE. THEY’RE ALL GOING TO ZERO.”

Millennials have to stop being exit liquidity for boomer retirements. No more buying $1M homes that were bought for $50k and a few blueberries. BTC will demonetize real estate and end the housing bubble. Join the winning team. Buy Bitcoin.

Jury is still out there whether we will continue to see diminishing returns in the future or a re-acceleration due to exponential s-curve type of adoption. What is clear though is that demand factors (BTCTCs, ETFs etc) are becoming more important than supply factors (Halving).

This guy gets it. We’ve been saying same thing. Since BlackRock filing Bitcoin is up like 250% with much less volatility and no vomit-inducing drawdowns. This has helped it attract even bigger fish and gives it fighting chance to be adopted as currency. Downside is prob no more…

Wild stat… Companies have raised nearly $86bil this yr to buy bitcoin & other crypto. That’s more than *double* the amount raised in US IPOs in 2025. via @GZuckerman @Vlajournaliste

WATCH: THE RACE TO SECOND BEST The top 2-11 corporate #Bitcoin holders have changed a lot from 2020 to today. See who climbs and who fades… 🔥

No, bitcoin reacted like intended. This is exactly what 80k BTC cause. x.com/andre_dragosch…

80,000 BTC, over $9 billion, was sold into open market order books, and bitcoin barely moved. That's the story.

FWIW — 80k BTC sounds like a lot (it is a lot tbh) but it only represents 2.7% of global #bitcoin exchange balances. You would expect around 2.7% * -1.3 = -3.5% drawdown from this which is exactly what the market has done. 🤷🏻♂️ -1.3 is the avg sensitivity to whale inflows.

JUST IN: Galaxy Digital announced it executed one of the largest notional bitcoin transactions in history, selling over 80,000 bitcoin worth more than $9 billion 🤯