Amberdata

@Amberdataio

Amberdata is the leading provider of digital asset data. Visit the Amberdata Derivatives Twitter - https://x.com/GenesisVol

Amberdata Market Data Now Available for Online Purchase! Get institutional-grade crypto data fast with our easy online checkout! 🎯 What’s Inside: - Customizable Spot, Futures, & Options data packages (monthly or yearly). - Delivered via RESTful API or WebSockets for seamless…

From Mining BTC to Powering Wall Street-Grade Crypto Analytics 📡 In 2010, @shawn_douglass was mining Bitcoin with a homemade ASIC rig in Sunnyvale. By 2017, he’d founded Amberdata to bring real-time analytics to the chaos of crypto markets. Today, Amberdata powers data…

📊 83% of institutional investors plan to boost crypto allocations in 2025. But with higher returns come higher risks. Our latest blog covers 4 key strategies to manage them: ✅ Counterparty risk ✅ Volatility ✅ Liquidity ✅ Drawdowns 🔗 Read more: hubs.la/Q03yZ4fC0

We’re proud to share that Amberdata has been named Most Innovative Digital Asset Research Platform – USA 2025 by The Brands Review Magazine Awards! 🏆 This recognition celebrates our commitment to pushing the boundaries of digital asset research and delivering best-in-class…

Crypto’s Bloomberg? Why Amberdata Is Betting on Institutional DeFi with @shawn_douglass "We process $600 billion in daily crypto transactions, yet most people still think we're in the 'Wild West." While retail debates meme coins, @Fidelity, @Citi, and regulators now depend on…

Altcoin Season Looms for Cautious Crypto Investors ⚠️ In a recent @axios article, Greg Magadini, Director of Derivatives at Amberdata, said, “Altcoins present an opportunity for the average person to get returns on the crypto spot market that traditional traders only get with…

Amberdata is heading to @BlockworksDAS 2025 in London as a Gold Sponsor! Let’s talk tokenization, data, and the future of institutional crypto. 🗓️ Oct 13-15 | Old Bilingsgate 🎟️ Use AMBERDATA10 for 10% off Learn more about Amberdata at DAS London 2025: hubs.la/Q03yFndQ0

Amberdata Podcast: Christine Kim on Ethereum, Tokenomics, & Governance 🐎 @christine_dkim, former VP of Research @glxyresearch, discusses ETH's protocol development, the evolution of token-based governance & crypto's regulatory path. Watch full episode. blog.amberdata.io/amberdata-podc…

Why is Bitcoin’s volatility so low? New long-form by @SeanNotShorn and Greg Magadini (@Amberdataio) dives deep. They argue the divergence is structural, driven by institutional flows, ETH’s “digital oil” status, and MicroStrategy-style convert plays. Link in comments 👇

Crypto isn't just coins, it's an evolving ecosystem 🏵️ Explore how Amberdata equips banks, hedge funds, & regulators with real-time crypto data, predictive insights & market intelligence. Thanks to @TFinitive for the feature & our role in digital assets: hubs.la/Q03ygbkb0

ETH Supply Crunch Incoming? 🗜️ Greg Magadini, Director of Derivatives at Amberdata, highlights a major shift in a recent @ForbesCrypto article: “About 30% of all ETH is now staked,” reducing the tradable float just as ETF inflows and corporate demand accelerate. “Everyone is…

BTC up while ETH slightly down. 📈 BTC +1.5% 📉 ETH -1.6% BTC Sept options on Derive.xyz: • Put-call-ratio ~0.1 (10x more calls than puts) • Heavy call OI stacked at 130K, bullish bets loading up. 👀

Gold went from $35 → $700 in a decade. What does Bitcoin do in a post-USD confidence world? We’re finding out. 🧠 Greg Magadini from @Amberdataio + @RyanFredGrace 🍒 @tastyliveshow

Amberdata Derivatives Newsletter 💎 In this week's newsletter, we discuss how conflicting inflation data & Fed drama shook macro markets, while the GENIUS Act fueled a breakout in crypto, stablecoins, & web3 equities. Read the full newsletter here. hubs.la/Q03y5PNn0

The GENIUS Act could mark a turning point for stablecoins and U.S. government debt 📢 Greg Magadini, Director of Derivatives at Amberdata, explains how requiring stablecoins to be backed 1:1 by liquid reserves like U.S. T-bills creates a deeper alignment between crypto and…

Amberdata’s latest research report has volatility models turn stablecoin activity into real-time, predictive signals for Ethereum risk. Using XGBoost + SHAP, we reveal how USDC, USDT, and DAI repayment trends reliably forecast next-day volatility, bringing interpretability to…

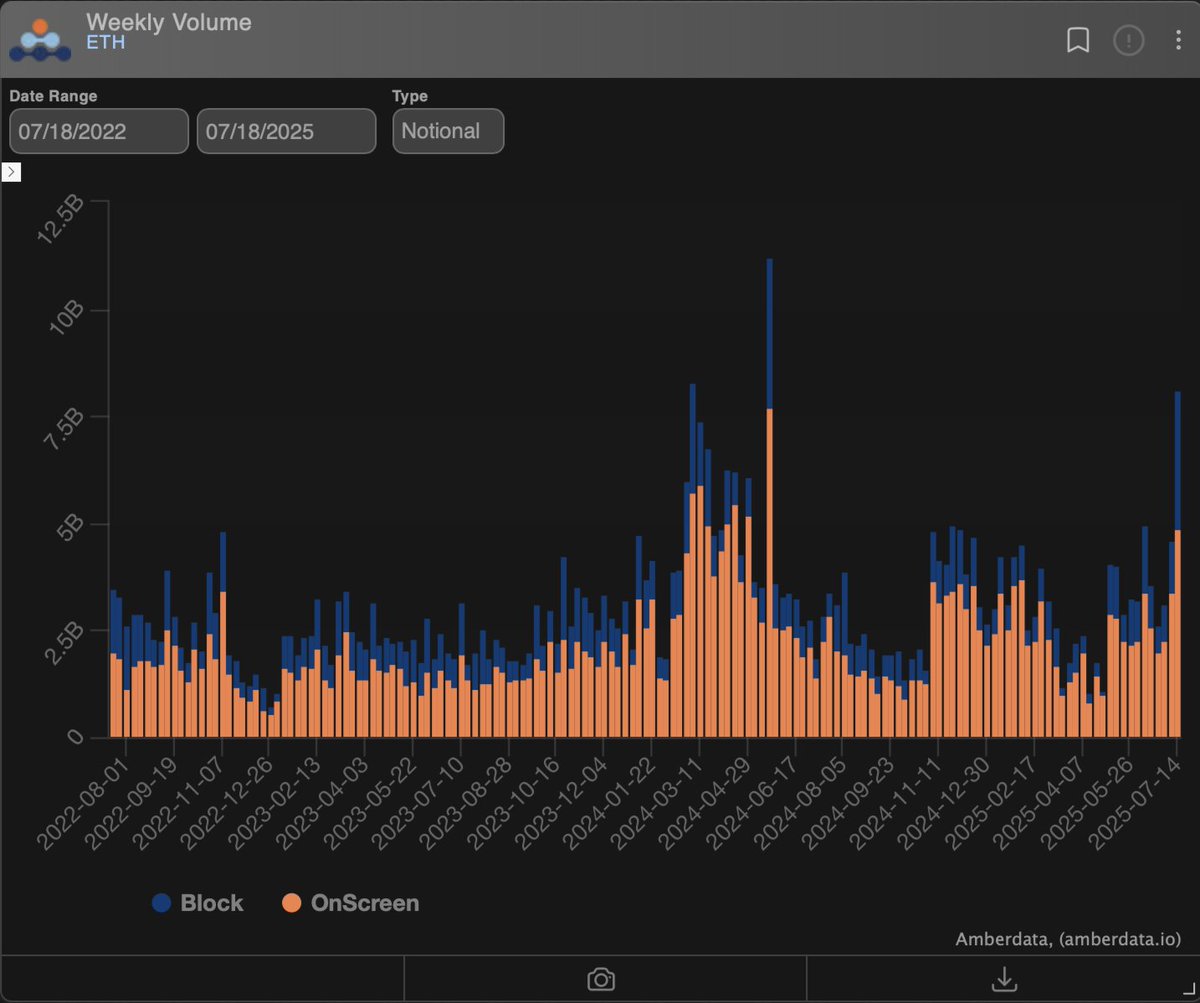

This week marks one of the top 3 highest weekly notional volumes for ETH options in the past 3 years. Both block and onscreen activity surged, signaling heightened institutional and directional positioning. Data via Amberdata Derivatives (pro.amberdata.io) 🔍

$600M In 1 Day: Why Are Bitcoin, Ethereum ETF Suddenly So Bullish? Greg Magadini, Director of Derivatives at Amberdata, says “Bitcoin has been a large benefactor of macro trends,” but the spotlight may be shifting. 🔦 ETH is gaining momentum as interest grows in…

The 2025 crypto bull market isn’t about memes, mania, or moonshots. 🌑 It’s about market structure, and at the center of it all sits one catalyst: spot Bitcoin ETFs. With $140B+ in flows and ETF custody draining exchange supply, this rally is being fueled by real capital, not…

ETH Comeback? ⚔️ “After two years of underperformance, ETH is gaining traction again,” said Greg Magadini, Director of Derivatives at Amberdata, told @DecryptMedia. “Today’s news is hitting BTC harder than ETH due to crypto-specific trades holding up ETH.” With notional open…

Crypto's Growing Maturity: The Rise of Derivatives 🌄 Jill Gao of @FalconXGlobal breaks down how institutional players from VCs to corporate treasuries are turning to crypto derivatives for yield, risk management, and diversification. Listen to the Amberdata Derivatives Podcast…