Alpha_Ex_LLC

@Alpha_Ex_LLC

Alpha Exchange is a podcast series by Dean Curnutt to explore topics in financial markets, risk management and capital allocation in the alternatives industry

Here’s the latest podcast, a discussion with Dan Villalon, Global Co-head of Portfolio Solutions, at AQR. We review Dan’s work on risk-managed funds that embed options. The findings are rather striking: across a wide sample of buffered funds and option-based strategies, very few…

I was on "Monetary Matters" hosted by @JackFarley96 ...chatted about bitcoin, gold and the price of insurance broadly. Take a look. Also on Apple podcast youtube.com/watch?v=bN3RiJ… podcasts.apple.com/us/podcast/bit…

Good Saturday…. Here’s the latest podcast. “Distributions have Consequences” I walk through the behavior of a new set of assets that very often experience rising implied volatility as the share price rises, not falls. Hope you enjoy it. Also on Spotify, etc.…

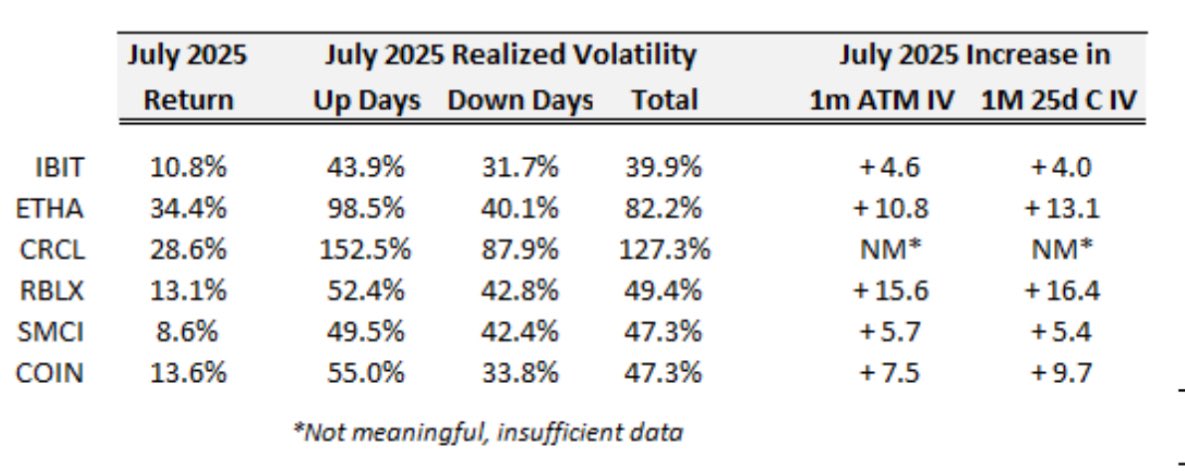

Glorious Friday to you…. look out for new podcast coming…For select assets, the correlation between the price and the implied volatility is actually positive and these are the most interesting (and highly traded) assets. The table below illustrates the strong performance of…

2 pods I recently really liked. First, Chanos handily beat Pierre Rochard in debating the MSTR to bitcoin premium in my view. Hard to argue against what Chanos lays out. Second, another Goldman Sachs exchange where the participants are not live with one another. Ken Rogoff…

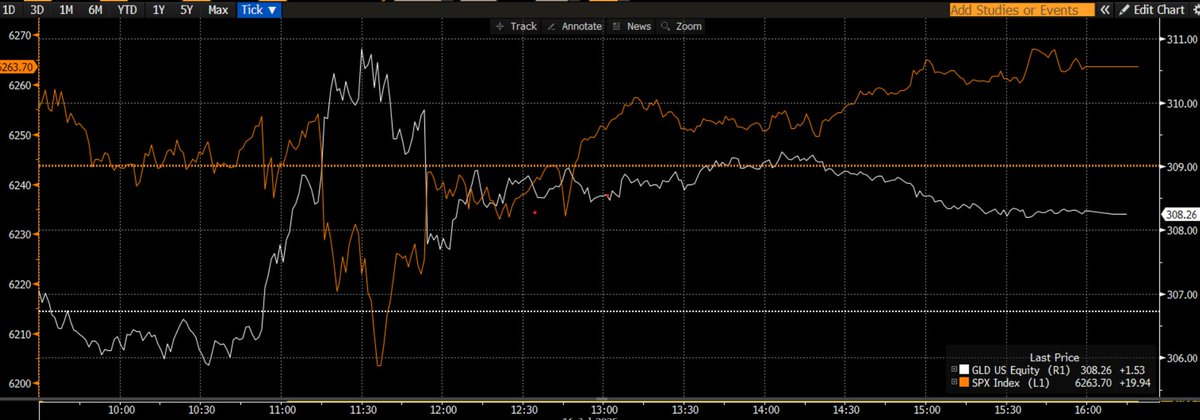

if you really really squint at the relative intradays on SPX and $GLD, you might be able to tell when both the "he's gone" vs. "never mind" headlines hit... we learn a lot by studying price and even more by studying correlation, or, in this case, anti-correlation. gold is where…

“Yeah, Bud. Call the Wall Street Chronicle. Tell them that Blue Horseshoe loves the 2x levered long on Bitcoin.”

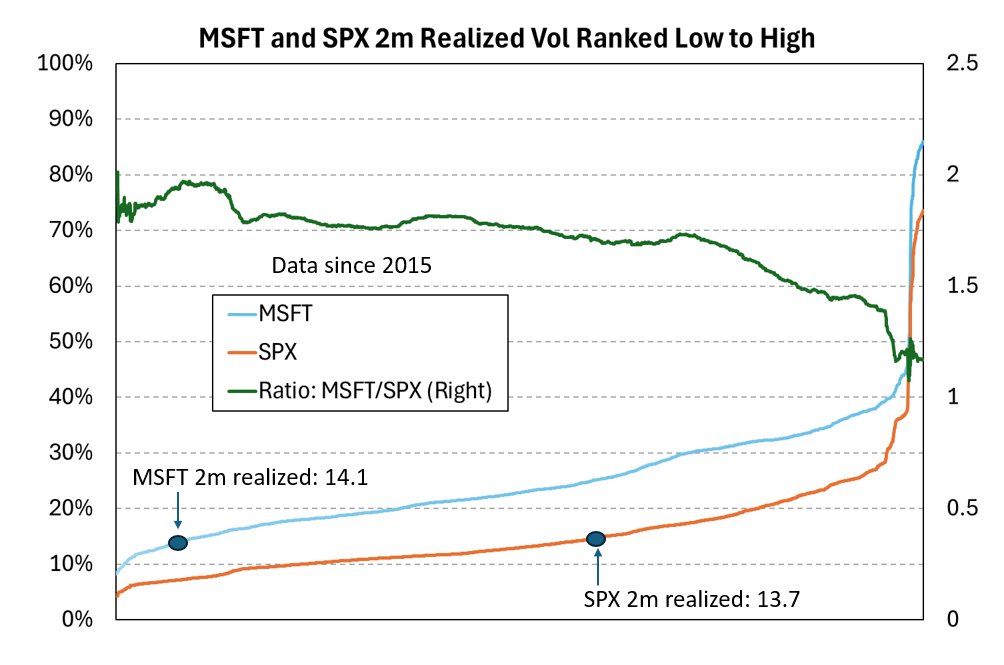

noticed how flatlined realized volatility has gotten in $MSFT recent and created this chart ranking 2m realized vol of both MSFT and SPX since 2015 from highest to lowest. there's a couple of things to point out... 1. both are roughly 14, but that's considerably lower in…

in 2026, Visa and Mastercard will turn 50 and 60, respectively. V went public in 2006, MA in 2008. Circle has 22 days of trading experience on the public markets. Yet, its option volume, on a notional basis, is 4 times that of V and MA combined (!) Circle's option volume is…