Jeffrey A. Hirsch

@AlmanacTrader

CEO Hirsch Holdings, Publisher Almanac Trader, Editor Stock Trader’s Almanac | “Those who understand market history are bound to profit from it!”

Limited time. Get a 2025 Stock Trader’s Almanac now, a 2026 Almanac later, my market calls, seasonality timing overlaid w/fundamental & technical analysis, sector ETF trades, and stock picks. stocktradersalmanac.com/LandingPages/S…

How Low Volatility Streaks End Matter! Difference in S&P 500 performance is eye-popping when separating past S&P 500 low volatility streaks (closing w/<+/- 1%) since 1950. Streaks that ended w/ a gain were bullish, those that ended w/ a loss were bearish. jeffhirsch.tumblr.com/post/789794128…

Thanks for building our platform!

🚀 CrossCheck Media is popping these days! #Streaming #Media #News #Business #StreamingNow #BusinessNews

Good timing indeed. @crypto_birb knows $BTC #BTC

🪙 With Bitcoin topping $120,000, there's no better time than now to repost this exclusive interview between @AlmanacTrader and @crypto_birb! ➡️ Watch now: youtu.be/1QJMqzyUqeQ?si… #Crypto #CryptoWeek #Bitcoin #Currency #Investing #Trading | @XCheckMedia

👀

Everyone has gone batshit euphoric on stocks at the moment where seasonality favors a higher $VIX. You will remember me. Goodnight.

The longer a historical low volatility streak persisted, generally the weaker S&P 500 was during the 3 months after the streak ended. Past streaks that lasted between 26 to 30 trading days, or longer than 40 trading days, were noticeably weaker.

S&P 500 low volatility streak extends to 18 trading days w/o 1% move. S&P 500 has retreated when past streaks ended. jeffhirsch.tumblr.com/post/789721940…

S&P 500 low volatility streak extends to 18 trading days w/o 1% move. S&P 500 has retreated when past streaks ended. jeffhirsch.tumblr.com/post/789721940…

Join us at 1 PM EST this Thursday on Spaces! Topic: Teflon Market, Buy Every Dip? HOST: @WOLF_TradingX Co-Hosts: @XFunds_ @WOLF_Financial Speakers: @AustinHankwitz @AlmanacTrader @qmbigbeat @JayWoods3 @Kross_Roads @LouBasenese @JasonP138 @optionspit

Got technical w/ the man the legend John @bbands Bollinger on the podcast. Breaking down his Rational Analysis combo technical, fundamental, & behavioral, structural shifts due to ETFs, options, futures, value of manually calculating indicators—esp. in volatile conditions.

🎯 Legendary market technician John Bollinger joins Jeffrey Hirsch on WealthWise! 💡 Learn how to navigate volatility, use Bollinger Bands® like a pro & prep for what’s next in the markets. 📺 Watch: youtu.be/y_a0ETtFGqk?si… 🎧 Listen: open.spotify.com/episode/07pL42… #Investing #News

👀

The last phase is craziest one. It’s when many will turn millionaires. Also where most will buy the top. (and suffer the consequences) 2026 is for bears. So you only have one shot to make it right. Aim high but keep your eyes open. Q3 is pause, Q4 is fire. Are you ready?

🎙️ Just dropped a live episode of WealthWise w/market legend @bbands! We talk $QQQ sell signals, market breadth, ETF distortions, Bollinger Bands & the art of Rational Analysis. open.spotify.com/episode/1rwTGC…

🎧

Just listened to the pod on Spotify. Just great! Loved the reflections on the past, e.g., paper, pencils, pencil sharpeners, adding machines, etc. And John Bollinger is a goldmine of insights, almost all of which were new to me. Treasure chest episode! open.spotify.com/episode/1rwTGC…

👀 Nice chart from @McClellanOsc $BTC #bitcoin $IBIT #COT

The small "non-reportable" traders of micro-Bitcoin futures are perennially optimistic, and have been net long as a group since the start of COT Rpt. coverage, albeit to varying degrees. This week they are super excited, a condition which does not usually work out well for them.

👀

The VIX Index did not confirm the higher SP500 price high made on Thursday.

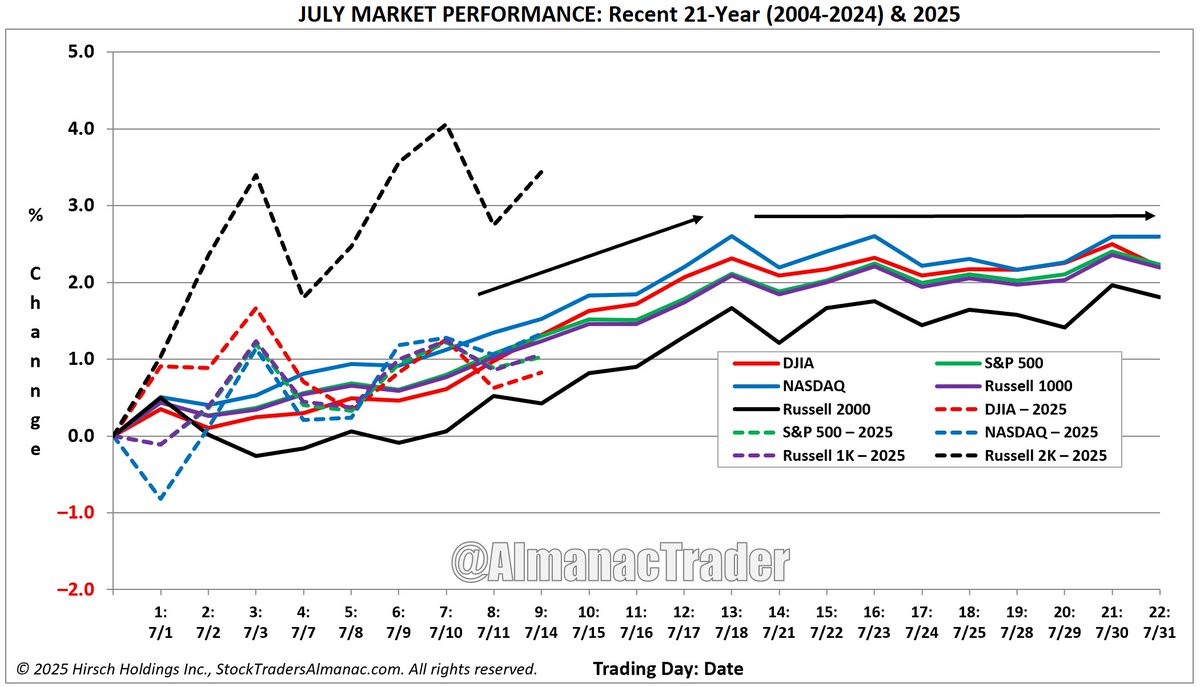

Markets usually weaken from mid-July, with average losses through September for DJIA, S&P 500, and NASDAQ. DJIA loses 1.5% and is up only 40% of the time during this period. August & September are historically worst months, especially for DJIA & NASDAQ. Credit: @AlmanacTrader

Market’s Summer Retreat has started around mid-July. Since 1990, DJIA, S&P 500, and NASDAQ all negative from mid-July through the end of September. jeffhirsch.tumblr.com/post/789252864…

Broke down #Bitcoin chart predictions ahead of the pump with legendary @DKellerCMT Huge shoutout @AlmanacTrader Watch: youtu.be/NcWacj8nSr4

Summer Rally Room to Run But Running Out of Gas $DIA $SPY $QQQ $IWM NASDAQ Best 8 Months Seasonal MACD Sell Signal imminent jeffhirsch.tumblr.com/post/789082187…