Alan Smith

@AlanJLSmith

Wealth Management for Entrepreneurs | Founder | Storyteller | Truth Seeker | Podcast 🎧 🏴☠️ http://www.capital.co.uk

I share my thoughts about business building, entrepreneurship and wealth planning in my free newsletter. You can subscribe here ⬇️ …smith-bulletproofentrepreneur.kit.com/newsletter

EPISODE 75 IS OUT! The latest pile of TRAP has dropped! Besties @HatTipNick @CarlWidger @AlanJLSmith @MavenAdviser chew the FS-fat.. Question for the TRAP team? Click on the link in the pinned Tweet at the top of our timeline. buzzsprout.com/2056762/episod…

Spoke with a business owner client recently who had a potential Inheritance Tax liability of £200,000. With Rachel Reeves proposed changes, that will increase to £3.4 million. He was OK with paying £200k, but will now take steps to reduce it to close to zero with sensible tax…

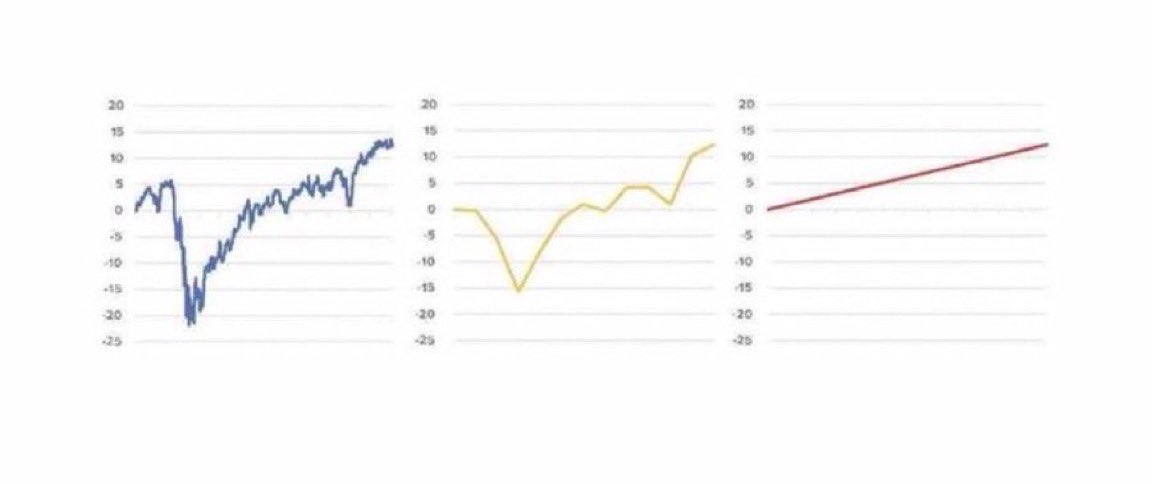

Three Investment Journeys: Which one do you prefer? Probably the 3rd one? Truth is they’re the same journey - the stock market in 2020. The difference is frequency of measurement: 1. daily 2. monthly 3. yearly The less you look, the less volatile the market appears.

When he was 42 he decided that he wanted to sell his business and be financially free by age 50. And he got there… Until the buyer pulled out of the deal a few days before closing! Incredible insights for all business owners and entrepreneurs from Graeme Godfrey.…

This is hilarious! Vanguard won’t buy bitcoin. But they’ll buy leveraged bitcoin.

In 2020, the UK government only had to pay 0.6% on 30 yr gilts. Today it has to pay 5.5%. Imagine your mortgage costs went up 9X and so you had to keep borrowing more just to pay the higher interest. Unlikely to end well.

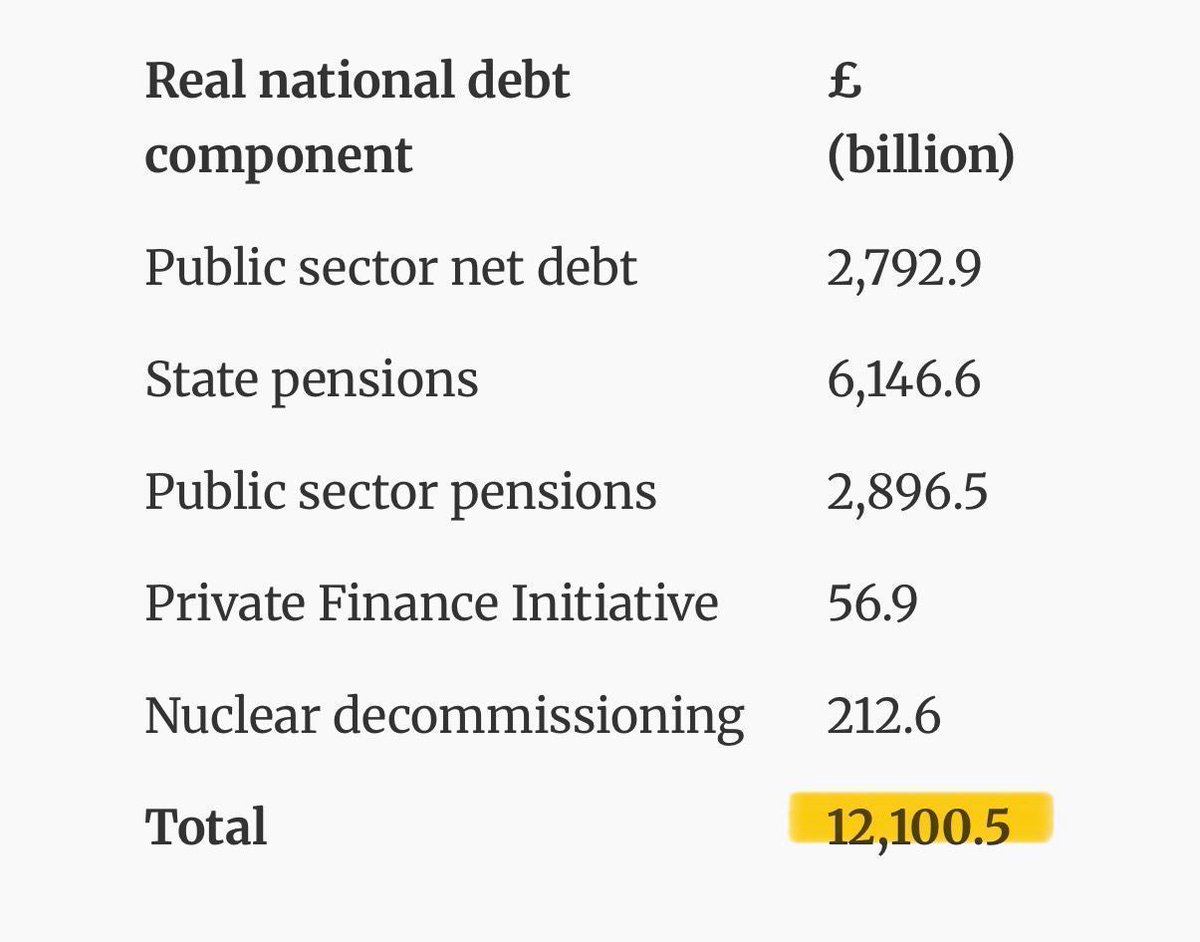

When unfunded public sector pensions and state pensions are included, UK national debt is over £12 trillion. The only way this can be funded is more and more money printing. This means more inflation, debasement and greater wealth gap. Slow motion financial car crash.

I wish we could create a UK version of this, help every child and get people interested in saving and investing. Funded by reducing government waste and inefficiency. @garyseconomics won’t approve though. @InvestAmerica24 @altcap

💡 The money we use today is only 54 years old. And most of us were never taught how it actually works. Growing up, I certainly wasn’t. Once you take the time to understand it, everything becomes a lot easier. From my conversation with @AlanJLSmith

Most people are getting poorer every year. This isn’t about old v young. This isn’t about rich v poor. This is about a broken political and monetary system.

This might backfire for Starmer. I just asked my 16-year-old son who he’d vote for. His reply: “Anyone but this lot”.

Started listening to the @AlanJLSmith podcast after the one with @JayW132 my new favourite. If you’re looking for unvarnished, UK real world business discussions this was far more enjoyable than other UK equivalents (James Sinclair is also very good).

- Introduce a Wealth Tax - Increase Capital Gains Tax - Inheritance Tax on pensions - Or reduce spending?