Neil Borate

@ActusDei

Deputy Editor at Mint (http://livemint.com) heading the Personal Finance team

There are now fake profiles impersonating me. I don't give any stock tips in any telegram or other channels. I have no other X accounts. I'm pinning this tweet since I've discovered that some people who follow me have started following the fake profiles too.

To all those who are confused about the age—she completed 12th at 12 years of age and college at 19. Exceptional case, so the confusion is valid, but the information is correct.

Today, Shipra Singh profiles a young techie in Seattle, Divya Saini. Divya thinks that US salaries are only marginally higher after adjusting for living costs. Rent alone is $2,150. 1) She spends 20% of her pay on rent & 25% on travel 2) She invests 20% of her salary, mostly in…

She completed her 12th at 12 and college at 19. We’ve seen the certificates :)

she probably has a minimum post deduction take home of 120k and is saving 20-24k a year. im guessing saving 20L in india would need a CTC of 60L+

The Sebi Consultation Paper on Mutual Fund Categories. 2 areas of concern: 1) Creation of 'Orphan' schemes 2) Tax on target date FoFs

Monsoon is the season to do Mumbai-Pune-Mumbai! Vistadome is indeed a good option. But even a drive or a bus ride is great.

Why you should get up at 6 am to catch the Deccan Queen Vistadome 😊

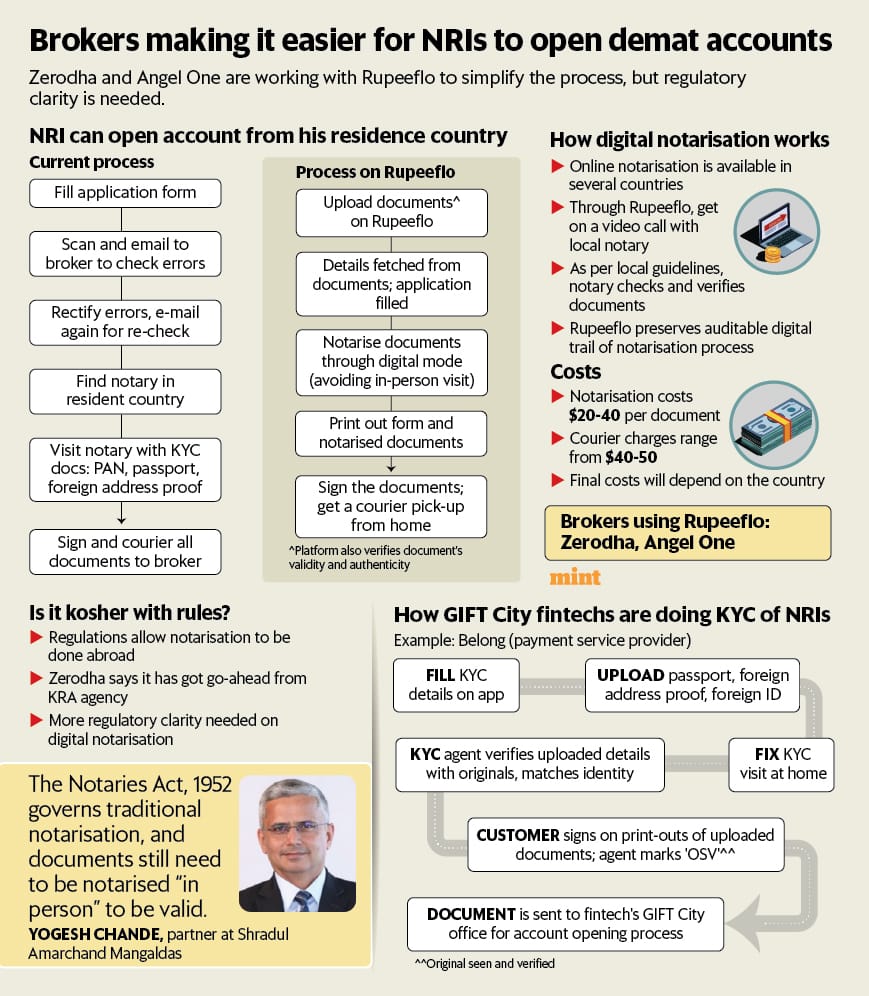

Opening a demat account from abroad is very hard for NRIs. But fintechs have created some tweaks like video notarization. Another pathway is GIFT city. Story by Jash Kriplani, CFP® livemint.com/money/personal…

Why you should get up at 6 am to catch the Deccan Queen Vistadome 😊

Certainly, he has helped me with the query. Thanks much, Neil 😀

How will they handle such a large AUM? - look at fund level AUM and not scheme level AUM as individual stock limits are at fund level, not scheme. So the best stock idea can have good allocation in one scheme instead of allocating the same idea in multiple schemes- basically…

I’ve been investing in PPFAS Flexi Cap for the past 5–6 years. It’s a solid fund with a great track record and what I like most is its clear goal: generate long-term capital growth These days, it feels like everyone invested in this fund. It’s become a staple in most portfolios.…

Should you follow a bucket strategy or a rebalancing one in retirement? 1) Bucket = 2 buckets. Equity & debt. Drink from debt in 1st 10 yrs & equity thereafter. Or some version of this plan with hybrids etc. 2) Rebalancing = 2 buckets but you keep shifting money when one rises…

Very good calculation.

Step-by-step retirement guide: 1: Annual expenses. Eg: 10 lakh 2: Inflate to retirement. Eg: 13 lakh in 5 yrs @ 5% inflation. 3: Thumb rule: Corpus = Expenses * No of ret yrs Eg: 13 lakh * 40 yrs = 5.2 cr Assumes corpus growth = inflation. It is conservative. 4 (Optional):…

Do register. Some interesting things happening in GIFT City

GIFT City is more than just tax perks. It’s the start of a new way NRIs interact with Indian finance. I’ll be breaking it down live with @neilborate on @livemint ! livemint.com/extraclass-nri

Easiest way to find out your retirement corpus. The early you start, more time you get and compounding helps you to achieve your goal. Thanks @livemint for sharing such insights!

Very nicely put @ActusDei. Seems to be a bit more conservative than standard 3% withdrawal (Corpus 33x of annual expenses in retirement) but again there is no such thing as too much Corpus 😁

Very good post Neil .. loved the simplicity of calculations and inducement to save minimum amount for focused retirement instead of complicated spreadsheets .. keep doing these simple things

Good one

Step-by-step retirement guide: 1: Annual expenses. Eg: 10 lakh 2: Inflate to retirement. Eg: 13 lakh in 5 yrs @ 5% inflation. 3: Thumb rule: Corpus = Expenses * No of ret yrs Eg: 13 lakh * 40 yrs = 5.2 cr Assumes corpus growth = inflation. It is conservative. 4 (Optional):…