Aaron Hector, R.F.P., CFP, TEP

@AaronHectorCFP

Passion for personal finance, innovative ideas & the well being of my clients. Founding Partner & Senior Wealth Advisor at TIER Wealth. President of the IAFP.

Estate planning exercise for married couples: List every single asset you own (bank account, investment account, car, trailer, home, cottage, etc) Make 3 columns and identify where the assets will fall into: 1. Joint 2. Beneficiary/Successor 3. Estate The jointly owned items…

Reminder that if you receive an inheritance, you should understand the differences between co-mingling that inheritance with your spouse vs. keeping it separate. There's no right or wrong here, but you really should understand the differences as you make choices about what to do.

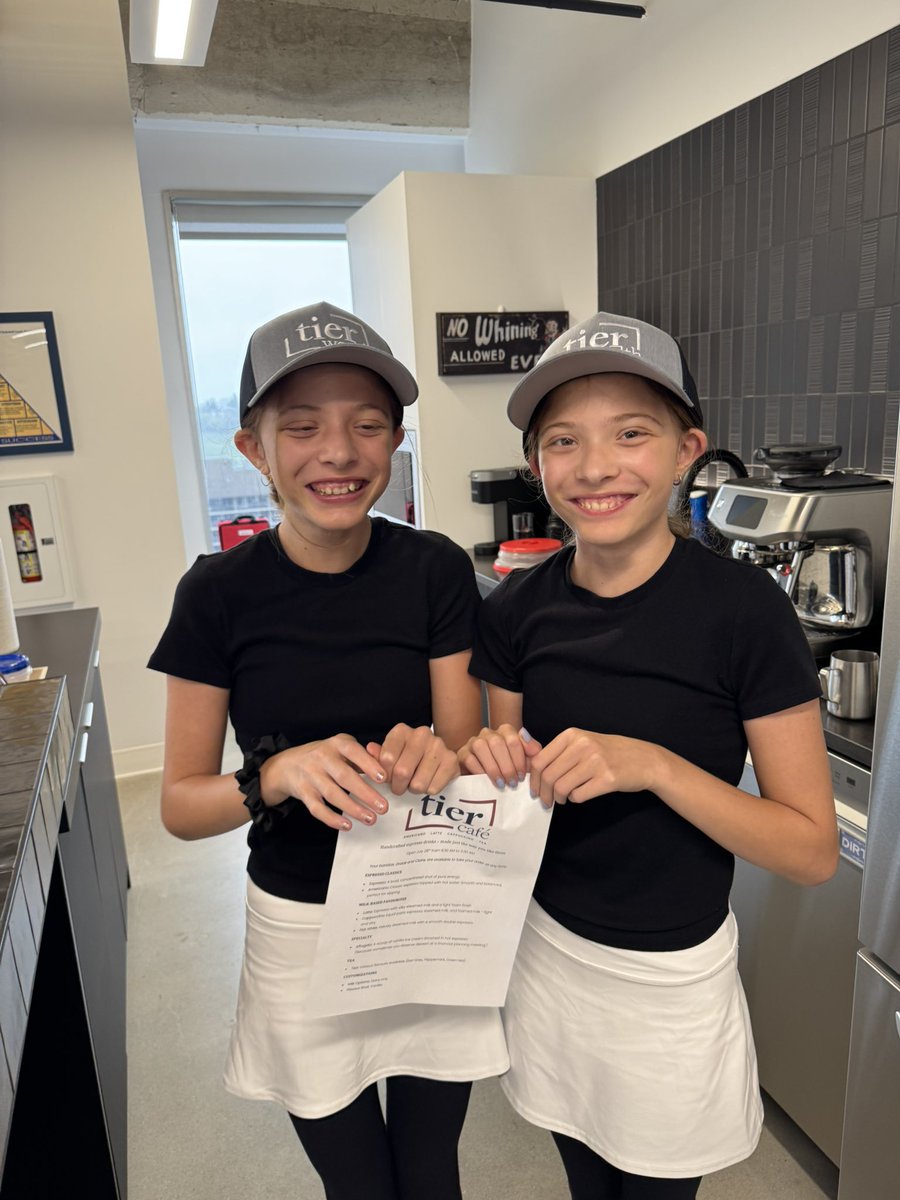

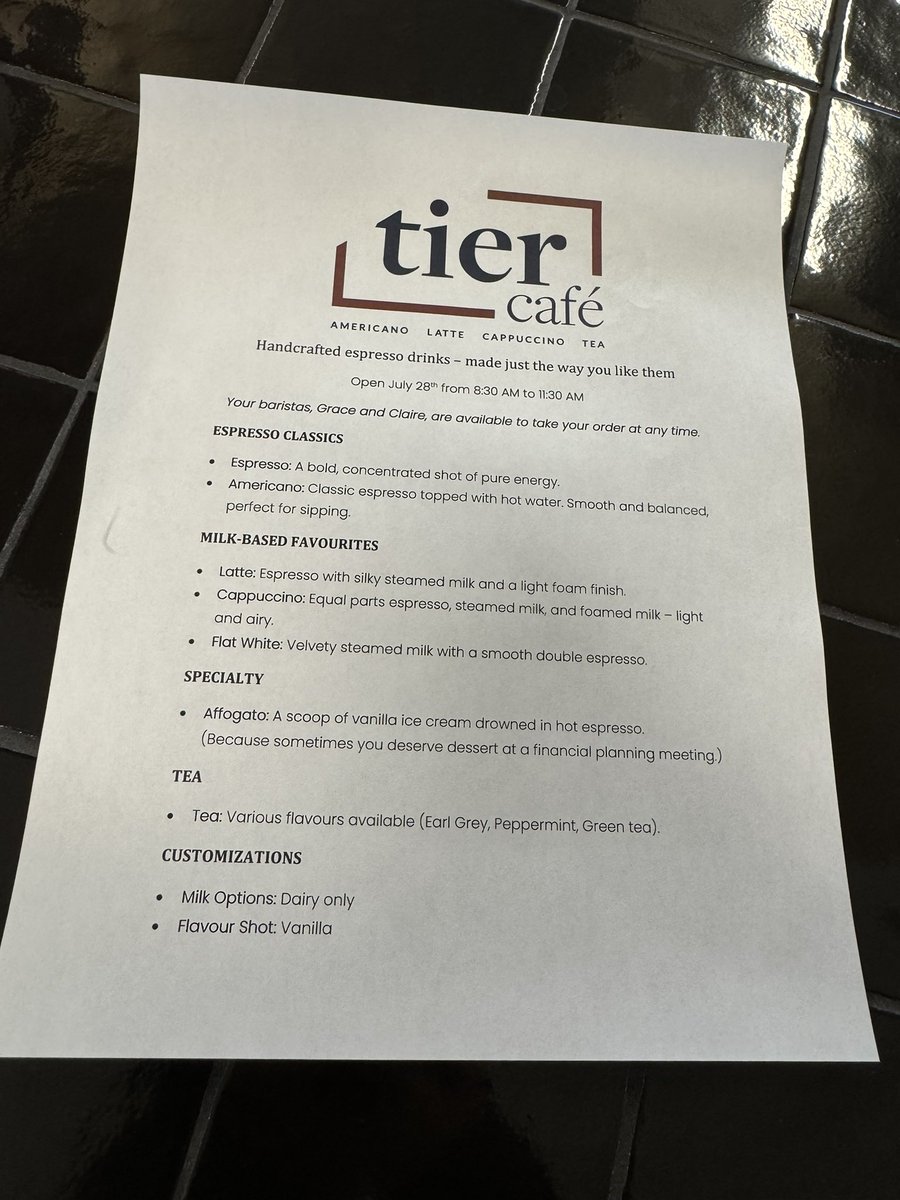

We had a wonderful start to the week at @TIERWealth today, with a few extra super cute hands on deck to get everyone caffeinated to start the week!

I was a guest on the Canadian Money Roadmap this week and we talked about all things estate planning. It’s an important topic that often gets overlooked. Highly recommend a listen.. Spotify and Apple links are below: open.spotify.com/episode/5xSGLw… podcasts.apple.com/ca/podcast/est…

If you're in your mid 60s and thinking about: - when to start OAS - have plans to sell a cottage/2nd home with large capital gains Factor that future sale into that OAS decision. If you start OAS at 65, and sell the cottage at 67... that capital gain at age 67 may result in…

Pictures can say a thousand words. Here’s a quick thread on dividends, as told by Granny Smith.

If any pension plan administrators see this: Please, I am begging you... start including verbiage in your pension estimate documents to clearly state whether the quoted monthly pension is expressed in today's dollars, or future dollars once the pension begins. Employees and…

The First Home Savings Account (FHSA) should be called the Savings Account For Those Who Haven't Lived in a Home They or Their Spouse Has Owned In The Current or Past 4 Years.

New digs!

Come take a tour of @qwealthpartners Calgary office at the iconic Ampersand building! We had a fantastic day with @AaronHectorCFP and our Partner Colin Andrews from @CanvasWealth It’s inspiring to work in such a vibrant, beautifully designed space!

Reminder - if you are taking regular withdrawals from your RRSP, you probably should be converting all or a portion (depending on your situation) to a RRIF and withdrawing from there instead. Withdrawal fee savings - ✅ Splittable w/ spouse + pension tax credit if over 65 - ✅

A thread on planning ahead and considering both your current and future effective tax rates when making FHSA contributions. (also useful for thinking about RRSP contributions!) 🧵👇

Calgary parking is ridiculous. I live about a 13 minute drive from my office. The monthly parking rate in my building downtown is $485, or $5820 per year. Gas would be more on top. I can uber to and from work with zero hassle for $27 per day (about $12 to $14 per direction).…