Aporia

@0xaporia

Απορώ και θαυμάζω

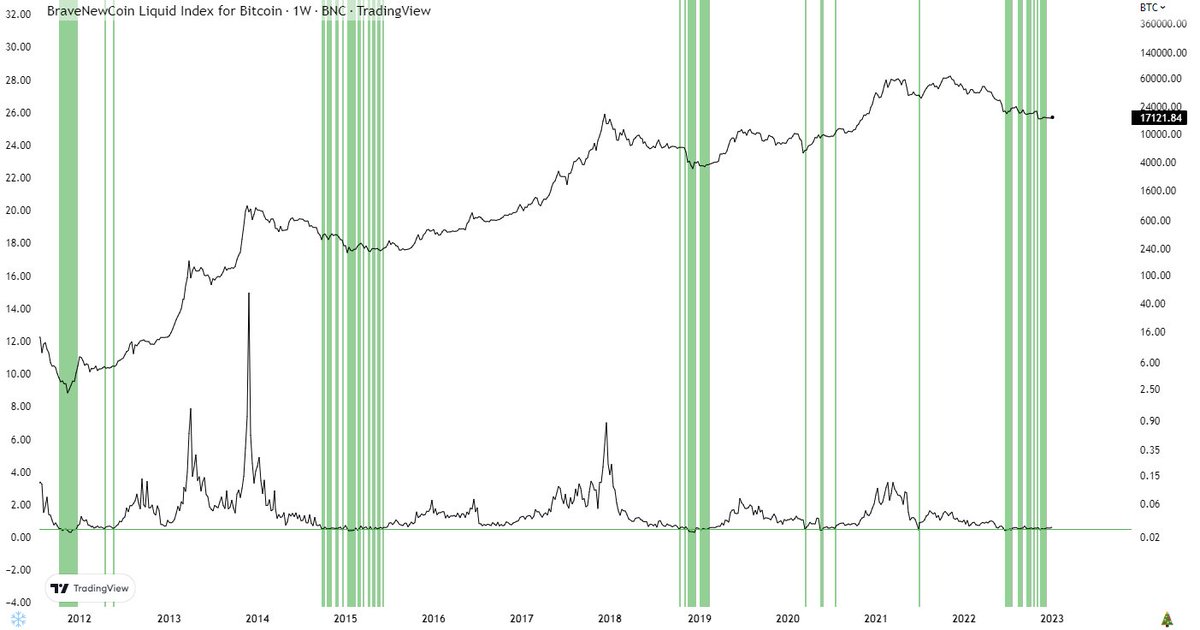

When the daily coin issuance denominated in USD falls below 50% of its 1-year moving average, compulsory sell-side liquidity is considered extremely low, leading to bottoms forming

Copying strategies without knowing how they’re built is renting. You might see results, but you're leaning on borrowed logic. The moment the strategy stops working, you’re cooked. Understanding their first principles is owning. Self-reliance starts by reversing what works and…

I wonder how much Aptos team paid for this tweet, quite desperate

Realistic 2025 crypto price predictions: Bitcoin - $150k Ethereum - $5k Chainlink - $30 BNB - $1k Aptos $10 What else? 🤔

You can go a long way with just basic trend-following principles. No need for prediction, macro analysis, or narrative weaving; you simply assume strength continues, and ride the inertia. It’s a low-assumption, high-payoff approach. The dumbest version of trend-following often…

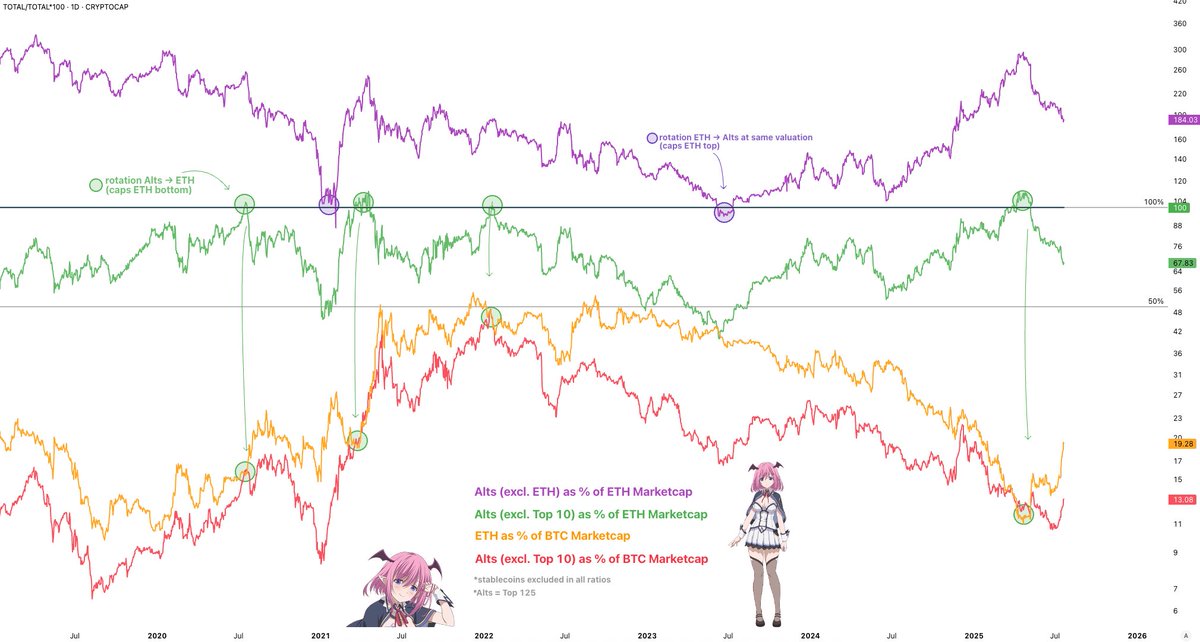

last cycle around this time ETH topped vs. BTC this time around it bottoms (for the sake of my bags)

waiting 6 months for a breakout just to sell on the first day of escape velocity? range trading has corrupted you, anon

“Listen, Larry. Litecoin is basically digital silver. Trust me. If it only sniffs 10% of BTC’s price, we’re booking massive profits”

MEI PHARMA LAUNCHES $100 MILLION LITECOIN TREASURY: LITECOIN BLOG

For the most part, trading psychology™ is a grift. You have no business managing emotions if you haven’t first built solid cognition. It’s like stressing about tire pressure on a car with no engine.

When someone tells you to avoid leverage he either 1) doesn’t understand leverage or 2) assumes you’re retarded, or both. Leverage is simply a tool to reduce counter party risk and increase capital efficiency. You use it to fit your predefined risk to a specific trade. The…

My key tip going into bull markets on #Altcoins. Don't use leverage. Don't monitor your trades too much. You'll make enough by trading spot. Volatility goes through the roof, your emotions go through the roof & corrections are going to be harsh. Stay sane.

Most people confuse trading (and betting in general) as games of prediction. They focus on being right, thinking profits follow accuracy. But the market doesn’t pay for correct guesses, it pays for correctly priced risk. Accuracy might feel good, but it's cosmetic. Imagine you…

“Lmao Saylor’s such an idiot, keeps buying the top – dude’s only up like 80% total.” - CT legends, currently down 80% on a low-cap gem they swore was the next ETH

MICROSTRATEGY PURCHASES 4,225 BITCOINS BETWEEN JUL 07 - JUL 13 AT AN AVERAGE OF $111,827 (TOTAL: $472.50M)