TEU

@0x_TEU

Have a cat named TEU 😺

ICYMI: $EKUBO fully diluted market cap is up by ~600% since launch @EkuboProtocol is a @Starknet-native DEX

A few vague lines about utility and nothing concrete, still don’t know what $PUMP actually does. What exactly are buyers at a $4B valuation expecting? 🙃

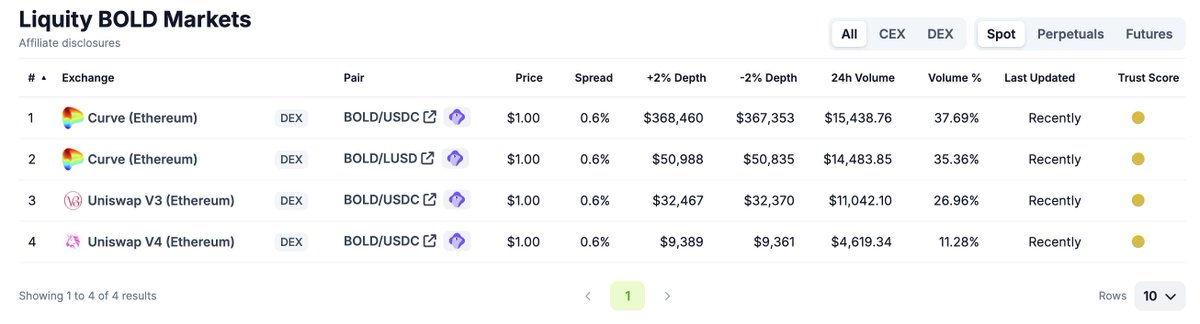

in the past 24 hrs @CurveFinance BOLD-USDC pool has done $30k volume @EkuboProtocol BOLD-USDC has done $492k volume one has $17mm+ in LPs, the other has $1.4mm

I stumbled upon a very detailed article about @EkuboProtocol, although it's quite late lol As a fan of $EKUBO, I created this one page summary to highlight the key points of article (tl;dr) and add a few of my own insights. There are many contributors in the @EkuboProtocol DAO,…

x.com/i/article/1935…

The efficiency of USDC/USDT isn’t just dependent on tight ranges and low fees, it’s also driven by @EkuboProtocol unmatched gas performance: • 38% cheaper than UniV4 • 55% cheaper than Fluid DEX As gas prices rise, this advantage will only grow.

Ekubo USDC-USDT LPs have earned $736 in fees today, while Fluid USDC-USDT LPs have earned $379 even though they are providing 38x more capital. Where would you rather provide liquidity?

Ironically, the so-called “AMM for stable pairs” is underperforming its competitors by a mile. TVL / 24h Volume: • Curve 3pool (0.015%): $180M / $26M • UniV4 USDC/USDT (0.001%): $18.5M / $270M • @EkuboProtocol USDC/USDT (0.0005%): $2.7M / $146M Something’s off.

🚨Milestone: Ekubo has just surpassed $200 million in 24-hour trading volume on the Ethereum mainnet!

I’ll explain @saylor's game and what it means for Crypto. Not investment advice, DYOR. >>

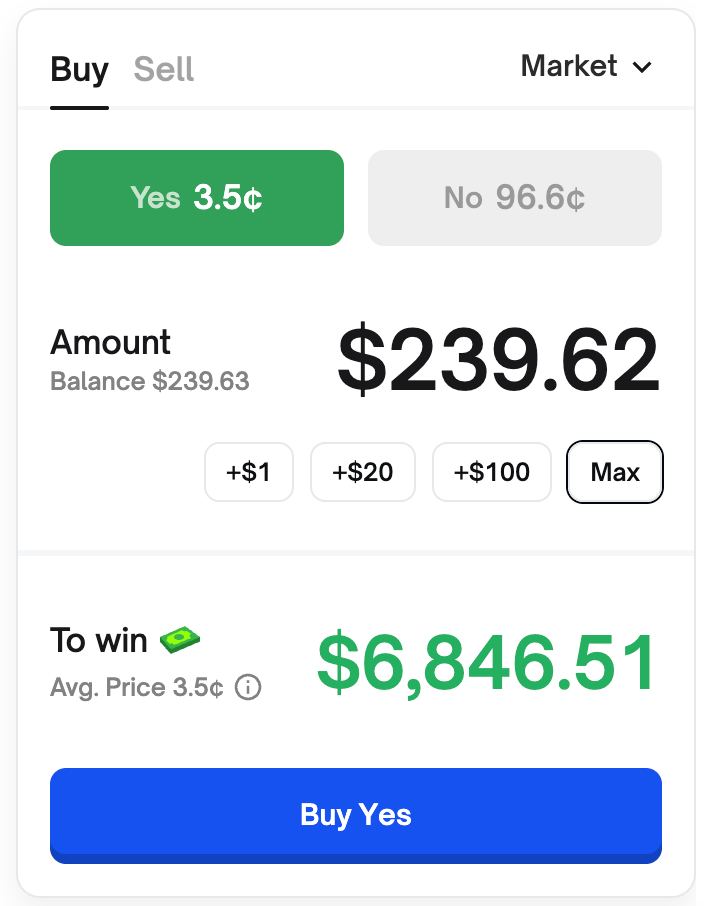

The BOLD/USDC pool on @EkuboProtocol is currently handling the majority of volume for @LiquityProtocol BOLD markets. Please consider listing us on @coingecko 🫡

Apps, product launches, acquisitions and more… Here are 28 things the Ethereum ecosystem got done over the last few weeks. 0/ @Shopify announced support for stablecoins on @base across their platform, giving millions of businesses in 175+ countries access to Ethereum-powered…

Ekubo’s withdrawal fee helps drive trader-friendly behavior. LPs need to think twice when picking a fee tier, it affects not just the trading fees they might earn, but also the cut they’ll pay to the protocol when pulling liquidity. In many cases, LPs aim for a sweet spot;…

There is a major misunderstanding about what the actual product is when it comes to stablecoins - particularly amongst DeFi stablecoin teams and investors. They fundamentally misunderstand the business of Tether and Circle, which is why they can’t compete with either

But much of what we ascribe to crypto is just geography of users. A crypto user in Argentina or Bangladesh just wants dollars. A fintech w access to money transmission rails in those countries would also do well. Demand is from the geography, not the technology.

A massive $EKUBO buy worth hundreds of thousands just hit both @Starknet and Ethereum. Smooth execution powered by @EkuboProtocol DCA order via DCA Pool.

🚀I just invested my STRK in the "Ekubo xSTRK/STRK" strategy at @trovesfi, earning an impressive 7.57% yield! 💸. Want in? Join me and start earning: troves.fi/r/evjhb0

🚨 BREAKING: Quorum PASSED for using $CASH to buyback $EKUBO! 🚨 Huge thanks to all the Ekuboians and Opians who cast their sacred votes 🗳️ Together, we’re unlocking more utility for $CASH 🔓 Don't forget to check out CASH<>EKUBO DCA pool. It's yielding pretty decent at 44%