Nico | ReflectMoney

@0xNIC0

Founder @ReflectMoney

btw i have nothing against @usebreezebaby i think its probably gonna be chad with devs like @_austbot my problem is that I'm autistic and actually believe I'm a part owner in the solana network state and fear for its neutrality.

The conflict of interest between members of the @SolanaFndn is getting out of hand. Directly using their position to benefit products from other places they work at. Disturbing to see the abuse via the @Solana page. This is not how you create a network of builders.

when we met with @ilmoi at @colosseum earlier this week, he said something that really stuck with me: "all crypto apps will eventually become banks; taking users' deposits and doing stuff with it" this really resonated because it's what we've believed in at @reflectmoney for a…

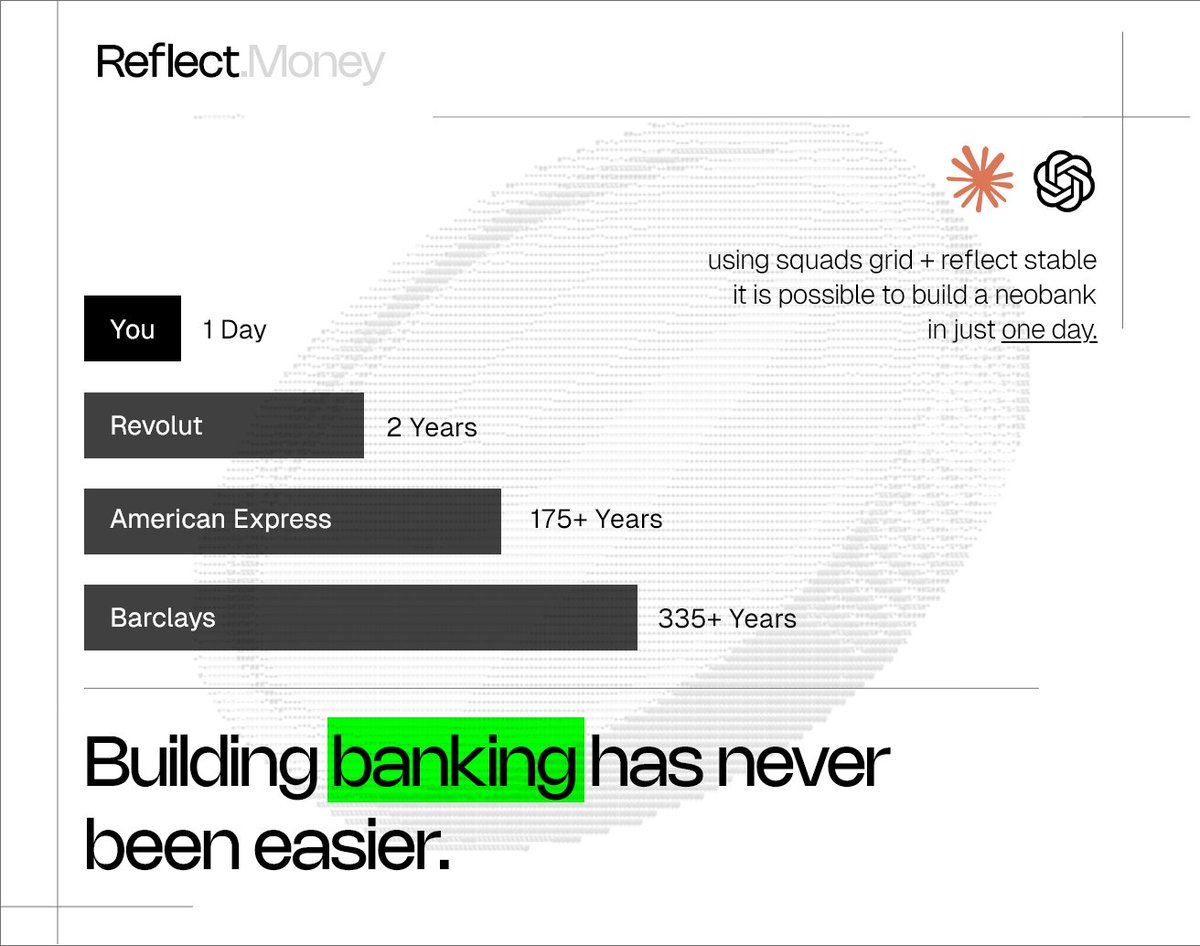

you want to build a neobank using stablecoins in 2025. > you pull grid SDK from @SquadsProtocol > you pull stableTS from @reflectmoney You now have cards, on/off ramp, minting/redemption, interest rates and insurance at your fingertips. Vibe code the next neobank ✨🧙♂️

How many founders trust their own "DeFi" protocol enough to put their entire portfolio within it. Thats a very intriguing piece of data id pay to own.

30.68% APY on Strategy 1 (Redacted) Stablecoin from @ReflectMoney. Lets just say, vaults will cease to exist once we are live - Why deposit your assets into a human-managed vault when you can hold them in your wallet and have 100% principal insurance?

you want to build a neobank using stablecoins in 2025. > you pull grid SDK from @SquadsProtocol > you pull stableTS from @reflectmoney You now have cards, on/off ramp, minting/redemption, interest rates and insurance at your fingertips. Vibe code the next neobank ✨🧙♂️

The capital efficiency system for all assets 🤠✨

Reflect Money joins the @Circle Alliance🤝 We're partnering directly with Circle Alliance to supercharge USDC yield on @Solana (+ SVM). The result? Anyone can now add native USD interest rates to their app with just a few lines of code✨

Remember kids, there is no leverage without liquidation. It’s literally not possible. People attempting to sell you this are very shady 💀✨

There are over 1,000 people who have provided their @X usernames in order to receive codes in the first batch of alpha-launch invites. We can't wait to see their reactions to our announcements. Get yourself ahead of the game by signing up via our website✨

GM, Audits almost done. @ReflectMoney currently has the highest yield on USDC without custodial deposit. i.e. it stays in your wallet. Codes will be posted as soon as audit is published. ✨👀

GM, Audits almost done. @ReflectMoney currently has the highest yield on USDC without custodial deposit. i.e. it stays in your wallet. Codes will be posted as soon as audit is published. ✨👀

The direct path for Crypto to fail as a means of permissionless finance is the very same pathway being championed by ETH maxis. Let’s say L2s do win, do you want to live in a world where your funds are owned by Blackrock sequencer? That’s not crypto, that’s faster tradfi.

Centralised lenders came and blew themselves up trying to do what code can do with humans. The same will happen with stablecoins. Decentralised Systems > Centralised Intermediaries 😤

AAVE is now holding 5% of all circulating stablecoins. More than the entire CeFi lending sector. What an insane growth.