Sam

@0xCryptoSam

research analyst @messaricrypto | covers DeFi, Trading, and Bitcoin Eco | prev pm @ether_fi | not financial advice

> Bitcoin pumps —> Alts consolidate > Bitcoin consolidates —> Alts rip Bitcoin is currently pumping as alts consolidate… what do you think happens next?

I've been convinced this tweet is wrong. Apart from high liquidity + CEX exposure, the main reason dino coins (i.e., XRP, HBAR, XLM, ADA, ALGO, etc.) are pumping is because investors are pricing in future treasury vehicles. Timelines have already begun to compress; SOL, HYPE,…

Those chasing ETH beta via DeFi tokens will be let down this bull run. DeFi summer taught us that value accrues from ETH -> DeFi projects. It's a logical conclusion, given that DeFi is the most popular sector on Ethereum. But what's become evident is the real ETH beta is…

Part of the reason this alt run feels real is that 1) ETH is pumping, and 2) it isn't an echo pump of tokens that we all knew were vaporware (Virtuals, ai16z, insert AI agent that was half-baked). Say what you will about ETH being overvalued, but at least it's a real network…

As the $XPL sale comes to a close, @SteimetzKinji raised one of the most interesting points I've heard on @PlasmaFDN and Bitcoin layers to date: "Plasma may test the true constraint on Bitcoin sidechains. With over $1 billion in initial stablecoin deposits, which exceeds the…

x.com/i/article/1932…

If you're betting on $ENA, the bet is that TradFi will want to move further out on the risk curve for stablecoins, and they'll express that with onchain stables over DeFi. But there's a lot to consider here. We can largely assume $ENA's $3.5B market cap (an $8B val) is from…

$ENA offers one of the only pure play exposures to stablecoins and tokenization, and now has the largest bazooka (relatively) of all tokens with a treasury company. Ideal timing with German regulator (BaFin) headwinds now behind us following a June resolution. Ethena is back in…

Pump looks cooked however you try and chalk it up. Whatever you think @a1lon9 planned to do with the $1.3b he raised, it doesn’t really matter now. The market has determined they won’t see any return, and so if they were to even get an airdrop, chances are it would be dumped…

Alon confirms there will be a $PUMP airdrop But it’s not coming anytime soon. (3/9)

There are basically 3 things that matter First - the debt based monetary system is collapsing. This is due to high rates, low productivity growth, hopeless demographic conditions and a general loss of faith in the system itself. This phenomenon is best described by George Soros…

The optimal portfolio theory is Puppets for BTC exposure and Azukis for ETH exposure

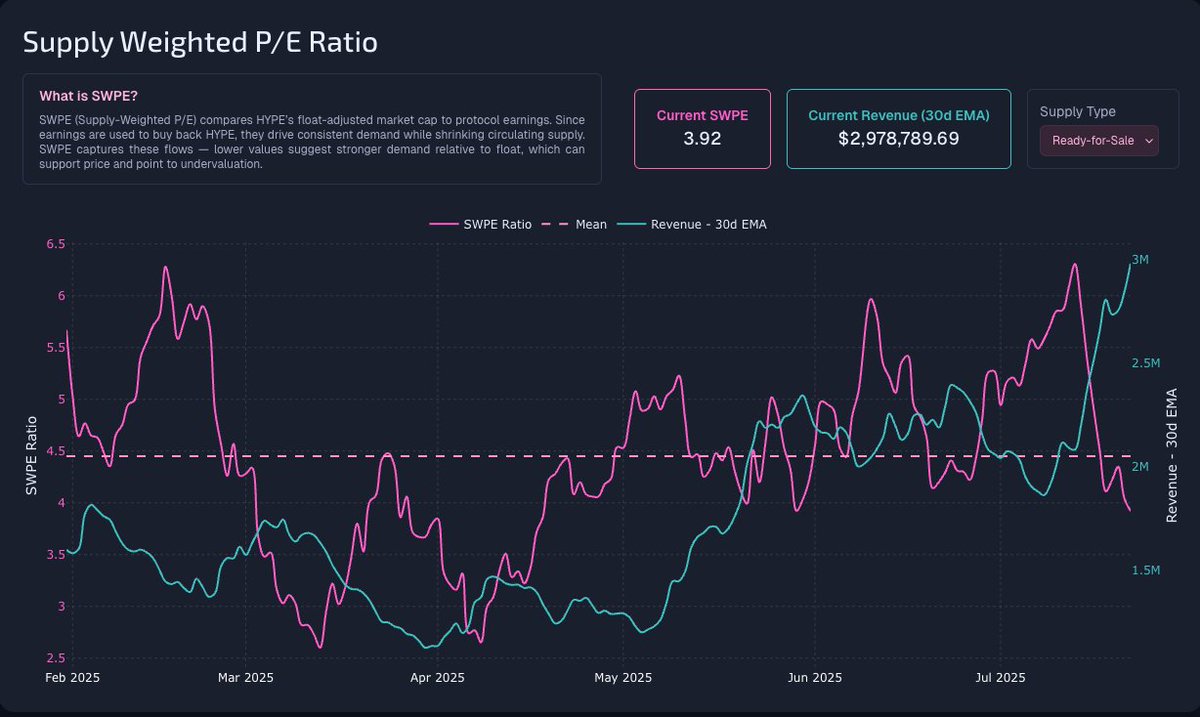

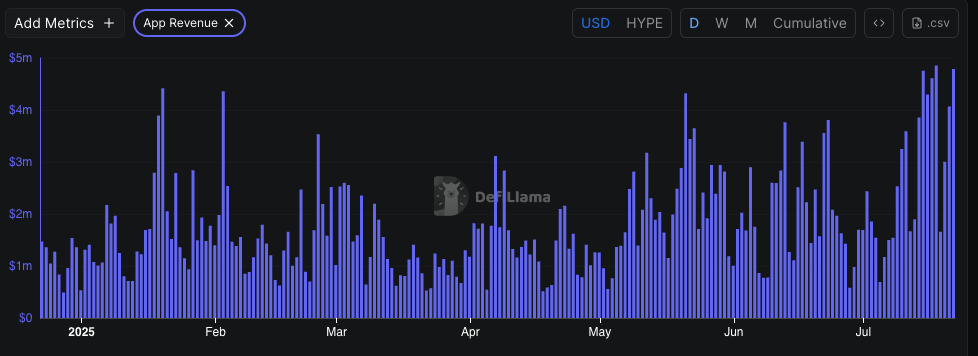

Hyperliquid's SWPE (supply weighted P/E) ratio just cratered from 7 -> 3.9 over the past week. This is one of the best buy signals for Hyperliquid. For context, Hyperliquid allocates 97% of protocol earnings to buying back HYPE through its Assistance Fund (AF), creating…

Two big reasons why CT is missing the action: 1) CT keeps fading boomer coins because it’s irrelevant tech compared to what they use onchain. They aren’t wrong, but retail doesn’t know what modern onchain tech looks like. They buy what they know (XRP, ADA, XLM, DOGE). 2) Most…

this is the closest its felt to 2021, yet i feel is the furthest crypto participants are from where the action is > xrp aths, no one owns that shit > eth aths, no one owns that shit > onchain? trenches? ai? what i would give for a fresh set of eyes to look at this

MORPHO is an example of a DeFi token I'd highly recommend to an investor who just wants to sit in a project for a bit. Good team, great equity structure, solid fundamentals, and an improvement on the current market leader (AAVE with their permissioned lending pools).

People talking about $AAVE but $MORPHO seems like a much better product that everyone I know actually uses and likes. It’s also directly integrated into coinbase. Their $cbBTC supply has like 5xed as a result. Instys will want isolated and tailored pools not pooled lending.

Those chasing ETH beta via DeFi tokens will be let down this bull run. DeFi summer taught us that value accrues from ETH -> DeFi projects. It's a logical conclusion, given that DeFi is the most popular sector on Ethereum. But what's become evident is the real ETH beta is…

Those chasing ETH beta via DeFi tokens will be let down this bull run. DeFi summer taught us that value accrues from ETH -> DeFi projects. It's a logical conclusion, given that DeFi is the most popular sector on Ethereum. But what's become evident is the real ETH beta is…

Those chasing ETH beta via DeFi tokens will be let down this bull run. DeFi summer taught us that value accrues from ETH -> DeFi projects. It's a logical conclusion, given that DeFi is the most popular sector on Ethereum. But what's become evident is the real ETH beta is…

Edge is quite literally everything in crypto today. The jackpot age is unsustainable. The winners will be those who have an edge and know where to find it. Good research is worth the investment.

If you're an active crypto investor, having a @MessariCrypto Enterprise subscription is a must. Our research team recently published in-depth research reports on @pumpdotfun and @PlasmaFDN, making sure our readers knew everything they needed to know BEFORE the token sales went…