Anteater

@0xAnteater

life is short. if you're a jerk, you'll be blocked.

created a tg channel where i’ll share my rapid market takes. t.me/AnteaterAmazon i really enjoy discussing my trade ideas with y’all. but realised that twitter isn’t the best platform for this. will keep my twitter to higher quality posts.

how much of the 86 billion is actually real net buying and not just in kind raises? the greatest irony of tcos is that they are far less transparent than crypto is the grift of the suits is worse than the grift in crypto

in the last 8 weeks - 98 companies - raised or announced plans to raise $86 billion to buy crypto - most have no revenue and minimal employees outside of IR, FinOp, and legal i think it only gets crazier - selling $1 for $3 and clipping 20% sponsor fees is too tempting

one of the biggest pain points Unit was supposed to solve was that it takes time to deposit to cex, then withdraw to bank, then deposit to ibkr. no longer a problem reuters.com/legal/governme…

we went from selling $1 for $0.6 to selling $0.6 for $3. and you think that this isn't potentially cycle ending?

with the way the tcos are structured and raising - i think this cycle is going to end a lot quicker than consensus so much supply frontloading. ironically, tokens were fairer. retail is left once again holding the bag

Perfect of example of when memes become the "picture is worth a thousand words"

Modern asset pricing theory they say

GOLDMAN SACHS AND BANK OF NEW YORK MELLON HAVE CREATED THE ABILITY FOR INSTITUTIONAL INVESTORS TO PURCHASE TOKENIZED MONEY MARKET FUNDS, CNBC HAS LEARNED. CLIENTS OF BNY, THE WORLD’S LARGEST CUSTODY BANK, WILL BE ABLE TO INVEST IN MONEY MARKET FUNDS WHOSE OWNERSHIP WILL BE…

Former market BTC treasury market darlings like $MSTR and $3350 JP have started to roll over, mNAV compression despite the BTC breakout last week~ US OTC vs JP ordinary share premia also suffering The simple explanation is capital is now chasing Eth, Doge, Hype, Tron etc…

hello dev?

According to Arkham, SpaceX has made a large on-chain move after three years. At 13:09 (UTC+8) today, the SpaceX-labeled address 15oKQ7...i7Jf1G transferred 1,308 BTC (worth approximately $153 million) to an unlabeled address: bc1q8k...phartf. The last outbound transfer from…

if you’re given insider information eg on what stocks to buy before they announce their TCO do NOT trade it. you may get away with it this administration, but you can and will be prosecuted for it in the future.

Reminder to market participants that crime isn't actually legal just because a few X anons said "crime szn" and investigations can come years later

Tom Lee BMNR mNav is now below Saylor's MSTR The new cantor ticker CEPO is $3.5B worth of Bitcoin trading at 1.15x mNav h/t @Void_of_Hype

ETH and SOL performance is being driven more by technicals than fundamentals at the moment, which explains the move over the last week. Still, Ethereum's share of onchain activity has been in decline since late 2Q24, while Solana currently owns 44% of all activity. Read more🧵👇…

potential sbr updates tomorrow and everyone is only long alts into it make it make sense

If you’re young and you make a lot of money this cycle this is an open letter to please actually go do something with your lives -Pay off debt -Be intentional and hang out with your family -Use financial freedom to learn new skills -Pursue a cool career arc without worrying…

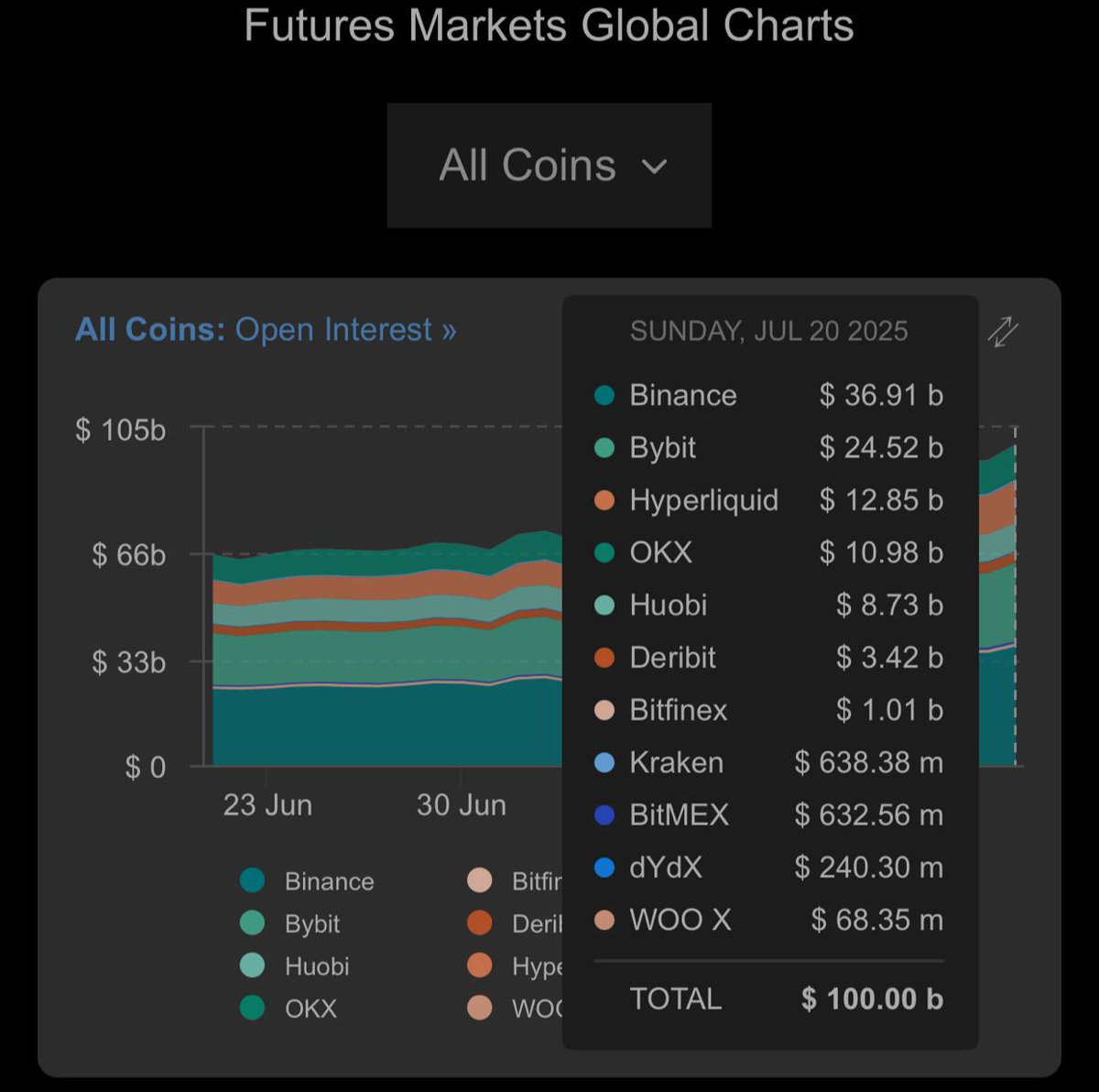

Its time to pay attention anons. Wen Alt coin OI is greater than $BTC OI you need to deleveraged and out of longs bc it indicates a local top. Still a few days, maybe max 2 weeks if I had to guess.

1 ondo = 1 condom, not condo

Reminder to market participants that crime isn't actually legal just because a few X anons said "crime szn" and investigations can come years later